Grid Selection Calculator

Enter your token's volatility or select from presets. This tool helps you choose the optimal grid size (0.01%, 0.05%, or 0.30%) for D5 Exchange based on your trading strategy and risk tolerance.

Select Your Trading Parameters

Ever wondered if a decentralized exchange can feel as smooth as a centralized one? D5 Exchange tries to answer that question by blending an on‑chain order book with the liquidity tricks of AMMs. Launched in 2023, it claims to give traders zero slippage, no impermanent loss, and full control of their assets-all without a central server. In this review we’ll break down how it works, who it’s best for, and what you should watch out for before diving in.

What Makes D5 Exchange Different?

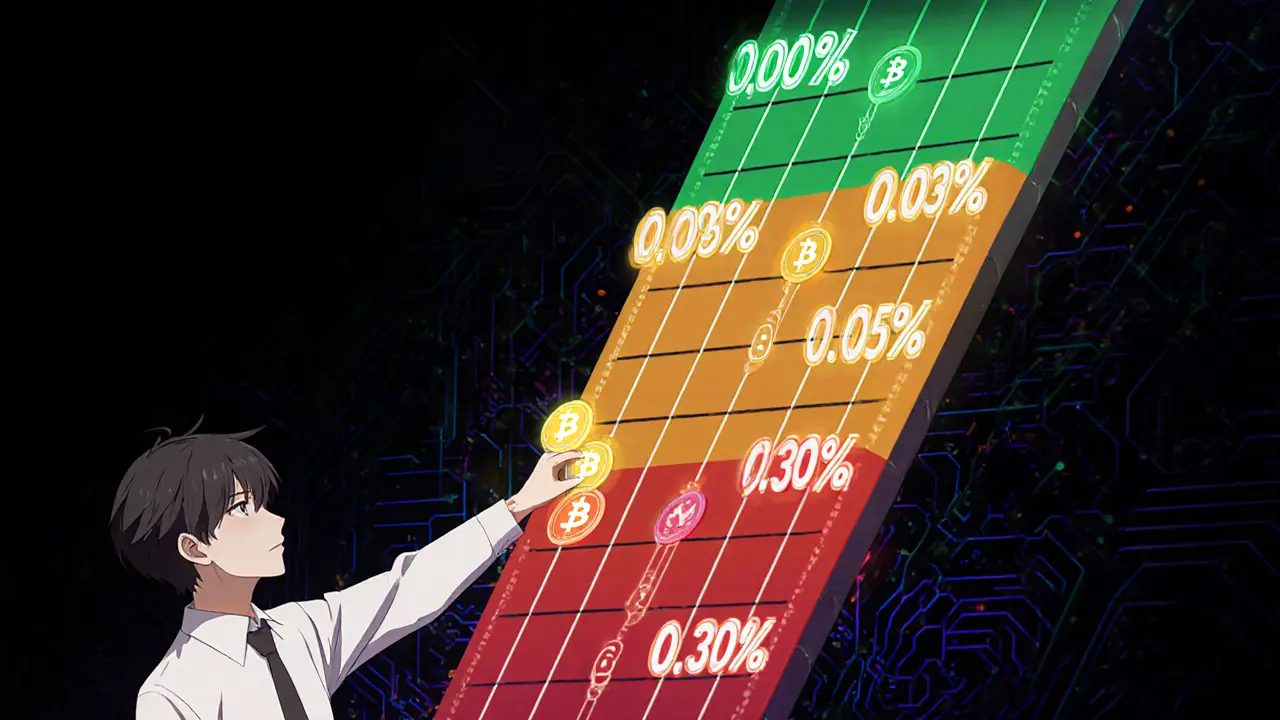

D5 Exchange is a decentralized cryptocurrency exchange that combines a traditional order book with automated market maker (AMM) liquidity pools, all on‑chain. Most DEXes, like Uniswap, rely purely on AMMs, which can cause slippage and impermanent loss. D5’s hybrid model, called the Grid Order Maker Book (GMOB), splits price ranges into three grids - 0.01%, 0.05% and 0.3% - letting traders pick the granularity that matches a token’s volatility.

This on‑chain order storage means the exchange never holds your funds; you stay the sole custodian. At the same time, the platform aggregates liquidity from Uniswap V2, Uniswap V3, Curve and other sources, so you still get deep pools and fast fills.

How the Grid System Works

The grid system is the heart of D5’s order‑book magic. Imagine a price ladder divided into tiny steps. When you place an order, you choose a grid size that fits the asset:

- 0.01% grid - ideal for stablecoins like USDT/USDC where prices barely move.

- 0.05% grid - works well for medium‑volatility tokens such as GDX.

- 0.30% grid - suited for high‑volatility assets where you want larger price jumps.

Each grid slot is an on‑chain limit order. When a matching order hits the same price slot, the trade settles instantly with zero slippage. Because the order book lives on Ethereum, Arbitrum or Optimism, you can verify every fill on a block explorer.

Supported Networks & Wallets

D5 runs on Ethereum Layer 1 and extends to popular Layer 2 solutions for cheaper, quicker trades. Currently supported networks include:

- Ethereum mainnet

- Arbitrum (a fast roll‑up that cuts gas by up to 95%)

- Optimism

- Polygon, Avalanche and other EVM‑compatible chains (via cross‑chain bridges)

Connecting a wallet is as easy as a click. The platform supports MetaMask, Coinbase Wallet, WalletConnect and several hardware wallets. If you’re new to DeFi, MetaMask’s browser extension is the most straightforward way to start.

Fees, Rewards, and Tokenomics

Trading fees on D5 are tiered based on the grid you select. The 0.01% grid typically costs 0.10% per trade, while the 0.30% grid can drop to 0.03% because makers earn more from the wider price bands. The fee structure is transparent: a small portion goes to liquidity providers, the rest is burned or allocated to the native GDX token (the governance and incentive token for D5 Exchange).

When D5 launched its GDX/ETH pair on Arbitrum, it offered a maker‑rewards campaign of 54 million GDX tokens. This “grid mining” incentivizes users to place limit orders that improve market depth. GDX’s tokenomics allocate 30% of the 200 million max supply to development and early investors, while 70% fuels community airdrops, staking rewards and the maker program.

Speed and Gas - Where Does Layer 2 Help?

On Ethereum mainnet, a simple trade can cost $5‑$10 in gas. Switching to Arbitrum or Optimism drops that to under $0.50 and reduces confirmation times from 15 seconds to 2‑3 seconds. D5 automatically routes you to the cheapest network for the chosen pair, so you don’t have to manually pick a layer.

In practice, a recent test on the GDX/USDC pair showed a 92% reduction in gas and a 3× faster fill compared to the same trade on Uniswap V3 on L1. The savings become noticeable for frequent traders or when moving larger amounts.

Security and Risks

Because D5 is fully on‑chain, there’s no custodial risk - you never hand over private keys. The code is open source, and the order book lives on smart contracts that can be audited. However, order‑book DEXes inherit a front‑running issue: bots can watch pending transactions and try to jump ahead. D5 mitigates this with a “commit‑reveal” scheme for high‑value orders, but fast‑moving traders should still watch the mempool.

Another caution: D5 is relatively new. Launched commercially in March 2023, its total value locked (TVL) trails behind giants like Uniswap (≈60% of DEX volume). Lower liquidity can mean bigger price impact for large swaps, even with the zero‑slippage promise.

User Experience - Is It Really Like a CEX?

First‑time users often compare the UI to Binance or Kraken. D5’s dashboard shows a classic order‑book view with depth charts, recent trades and a clean “Buy / Sell” panel. The “Grid Selector” dropdown lets you pick 0.01%, 0.05% or 0.30% instantly. For newbies, the learning curve is steeper than a simple AMM swap, but the platform offers video tutorials, step‑by‑step guides, and a Discord help channel.

Feedback from the community highlights a few pain points:

- Understanding grid selection takes a day or two for most newcomers.

- Advanced features like custom grid parameters are hidden in “Advanced Settings”.

- Occasional latency spikes when the Ethereum network is congested, though Layer 2 usage smooths this out.

Overall, traders who need precise price control and want to avoid slippage report high satisfaction, while casual users may stick with simpler AMM DEXes.

How D5 Stacks Up Against Competitors

| Feature | D5 Exchange | Uniswap (AMM) | Typical CEX (e.g., Binance) |

|---|---|---|---|

| Order Type | On‑chain limit order (grid) | Instant swap (no limit orders) | Limit & market orders (off‑chain) |

| Slippage | Zero (order matches exact price) | Variable, up to several % for low‑liquidity pairs | Usually low, but can increase during high volatility |

| Impermanent Loss | None (order book) | Present for LPs | Not applicable (custodial) |

| Custody | User retains private keys | User retains private keys | Exchange holds funds |

| Liquidity Sources | Hybrid: internal grid + Uniswap V2/V3, Curve | Uniswap V2/V3 pools | Centralized order book, many market makers |

| Network Fees | Variable; cheap on Arbitrum/Optimism | Variable; high on L1, lower on L2 | Flat trading fees, no gas |

| Front‑Running Risk | Present, mitigated via commit‑reveal | Minimal (swap is atomic) | Protected by exchange engine |

The table shows why D5 appeals to traders who crave the precision of a CEX but refuse to give up custody. If you value zero slippage above all, D5 is the only DEX that truly delivers.

Who Should Use D5 Exchange?

Based on the features above, here are three typical personas:

- Professional crypto traders - Need tight spreads, custom grid sizes, and the ability to earn maker rewards.

- DeFi enthusiasts - Want to stay non‑custodial while accessing deep liquidity from AMM pools.

- Token projects - Can list for free via permissionless listing, gaining exposure without a lengthy approval process.

If you’re a casual user who just wants to swap a few dollars, a simpler AMM DEX or a CEX might feel quicker. But for anyone serious about price control, D5 offers a compelling middle ground.

Future Roadmap and Outlook

Looking ahead, D5’s team plans to add more Layer 2 networks, improve cross‑chain bridges, and roll out institutional‑grade tools like API order routing and custom risk limits. Analysts expect order‑book DEXes to capture more market share as traders grow tired of AMM quirks. If D5 can keep expanding liquidity and smooth out the front‑running edge, it could become a go‑to hub for decentralized professional trading.

Bottom Line - Is D5 Worth Your Time?

Summing it up, D5 Exchange delivers a unique blend of on‑chain safety, zero slippage, and maker incentives that you won’t find on standard AMM platforms. The learning curve is real, and the platform’s youth means you’ll see growing pains in liquidity and occasional UI quirks. Still, for traders who value precise order control and want to stay in full custody of their crypto, D5 is a solid choice.

What networks does D5 Exchange support?

D5 runs on Ethereum mainnet and integrates with Layer 2 solutions such as Arbitrum, Optimism, Polygon, and Avalanche. The platform automatically routes trades to the cheapest network for each pair.

How does D5 eliminate slippage?

Trades are executed against on‑chain limit orders placed in a price grid. Since a match occurs only at the exact price you set, there is no price impact between order submission and execution.

Is there any custodial risk?

No. Your funds stay in your wallet until a trade settles on‑chain. D5 never holds private keys.

Can I list my token on D5 without approval?

Yes. D5 uses a permissionless listing model, so any ERC‑20 token can be added by providing the contract address.

What is the GDX token used for?

GDX powers governance, fuels maker‑reward campaigns, and can be staked for network incentives. It also serves as a fee‑discount token for frequent traders.

Comments

Elizabeth Mitchell

October 23, 2025 AT 08:44 AMD5’s hybrid model is a neat compromise between CEX speed and DeFi safety.

Chris Houser

October 23, 2025 AT 10:24 AMYo, the Grid Order Maker Book basically slices the price curve so you can drop limit orders in tiny steps. Pick the 0.01% grid for stablecoins and you’ll barely feel any slippage, while the 0.3% grid gives you room on volatile tokens. The fee tiers follow the grid size, so tighter grids cost a bit more, but the maker rewards can offset that if you’re active.

William Burns

October 23, 2025 AT 12:04 PMOne must acknowledge that D5’s architecture represents a paradigm shift, melding the deterministic precision of limit orders with the liquidity elasticity of AMM pools. Such a synthesis, while intellectually stimulating, inevitably incurs a complexity premium that novice traders may find arduous to comprehend.

Ashley Cecil

October 23, 2025 AT 13:44 PMFrom an ethical standpoint, any platform that retains user custody is preferable to custodial exchanges that expose funds to unilateral control. D5’s non‑custodial design aligns with the broader DeFi ethos of personal sovereignty.

John E Owren

October 23, 2025 AT 15:24 PMThe commit‑reveal scheme they use for high‑value orders adds a layer of protection against front‑running bots. It’s not perfect, but it shows the team is thinking about real‑world trading risks.

Joseph Eckelkamp

October 23, 2025 AT 17:04 PMAh, the noble pursuit of “protecting” traders from their own impatience-how very philosophical!; yet one must wonder if the added latency of commit‑reveal merely shifts the burden onto the user, who now waits for his order to be validated while the market gallops ahead.

Aniket Sable

October 23, 2025 AT 18:44 PMGreat stuff! D5 feels like the perfect middle ground for folks who want safety without sacrificing speed.

Santosh harnaval

October 23, 2025 AT 20:24 PMExactly, it’s like getting the best of both worlds.

Claymore girl Claymoreanime

October 23, 2025 AT 22:04 PMWhile the interface boasts a polished veneer, the underlying order‑book mechanics betray a certain opacity that warrants scrutiny. Users should not be lulled into complacency by sleek charts alone. The true test lies in how the platform handles extreme market turbulence.

Will Atkinson

October 23, 2025 AT 23:44 PMTrue, and let’s not forget that the colorful UI can mask latency spikes when Ethereum congestion spikes!; nevertheless, the visual clarity does help newcomers locate the grid selector quickly.

adam pop

October 24, 2025 AT 01:24 AMFront‑running bots are still lurking in the shadows, waiting to pounce on any unprotected order.

Dimitri Breiner

October 24, 2025 AT 03:04 AMThe maker‑reward program is a solid incentive for liquidity providers, especially on emerging L2s where TVL is still growing. Keep an eye on the reward decay schedule to gauge long‑term profitability.

angela sastre

October 24, 2025 AT 04:44 AMD5’s on‑chain order book is a fascinating experiment that deserves a closer look. First, the hybrid model eliminates the need to trust a centralized entity, which is a core principle of DeFi. Second, by aggregating liquidity from multiple AMM sources, it mitigates the thin‑pool problem that plagues many pure order‑book DEXes. Third, the grid system gives traders granular control over price execution, which is especially valuable for stablecoin arbitrage. Fourth, the zero‑slippage claim holds up when the grid matches exactly, but only if there is sufficient depth on the chosen grid. Fifth, the commit‑reveal mechanism provides a partial defense against front‑running, though sophisticated bots can still infer intent from gas patterns. Sixth, the fee structure is transparent, with higher fees on tighter grids that reflect the increased competition for liquidity. Seventh, the native GDX token serves multiple purposes-governance, fee discounts, and maker rewards-creating a self‑reinforcing ecosystem. Eighth, the platform’s support for multiple Layer‑2 solutions dramatically reduces gas costs, making frequent trading economically viable. Ninth, the user interface mirrors that of traditional CEXs, which eases onboarding for traders accustomed to order‑book dashboards. Tenth, the learning curve is steeper than a simple swap, requiring users to understand grid selection and risk management. Eleventh, the TVL is still modest compared to giants like Uniswap, meaning large orders may still experience price impact despite the zero‑slippage promise. Twelfth, security audits have been published, but the novelty of the hybrid architecture invites continuous scrutiny from the community. Thirteenth, D5’s permissionless token listing lowers barriers for new projects, fostering a more inclusive market. Fourteenth, cross‑chain bridges are in early stages, so users should be cautious when moving assets across chains. Fifteenth, the roadmap includes API order routing and institutional tools, which could broaden its appeal. Overall, D5 is a solid step forward for decentralized trading, but it remains a work‑in‑progress that demands careful use.

Prabhleen Bhatti

October 24, 2025 AT 06:24 AMIndeed, the integration of multiple L2s raises questions about cross‑chain atomicity; how does D5 ensure that a grid order placed on Arbitrum is reflected accurately on Optimism without introducing state‑sync latency? Additionally, the tokenomics of GDX could benefit from a clearer vesting schedule to alleviate concerns about early‑investor dilution-factors that merit further technical documentation.

Jennifer Rosada

October 24, 2025 AT 08:04 AMIt is imperative for any platform handling user funds to uphold the highest standards of transparency and security. D5’s open‑source contracts are a commendable step toward that goal.

Steve Roberts

October 24, 2025 AT 09:44 AMWhile transparency is laudable, one should remain skeptical of any new protocol’s long‑term resilience; history shows that many promising DEXes fade once market conditions shift.