Many people think Cuba banned cryptocurrency. That’s not true. In fact, Cuba is one of only two countries in the world that officially allows Bitcoin and other digital currencies as legal payment methods. The confusion comes from how the government handles it - not by banning it, but by tightly controlling it.

What Really Happened in 2021

In August 2021, Cuba’s government published Resolution 215 in its Official Gazette. This wasn’t a crackdown. It was a formal rulebook. The Central Bank of Cuba was given the power to license and monitor cryptocurrency businesses. The reason? "Reasons of socio-economic interest." Translation: Cubans needed a way to survive economic isolation. Before this, crypto existed in a gray zone. People were using it anyway - mostly Bitcoin and Ethereum - to send money from family abroad, buy goods online, or pay for services when banks refused to help. With Western Union shutting down its 400+ locations in Cuba in 2020, and U.S. sanctions blocking PayPal, Venmo, and credit card use, crypto became a lifeline.How It Works Today

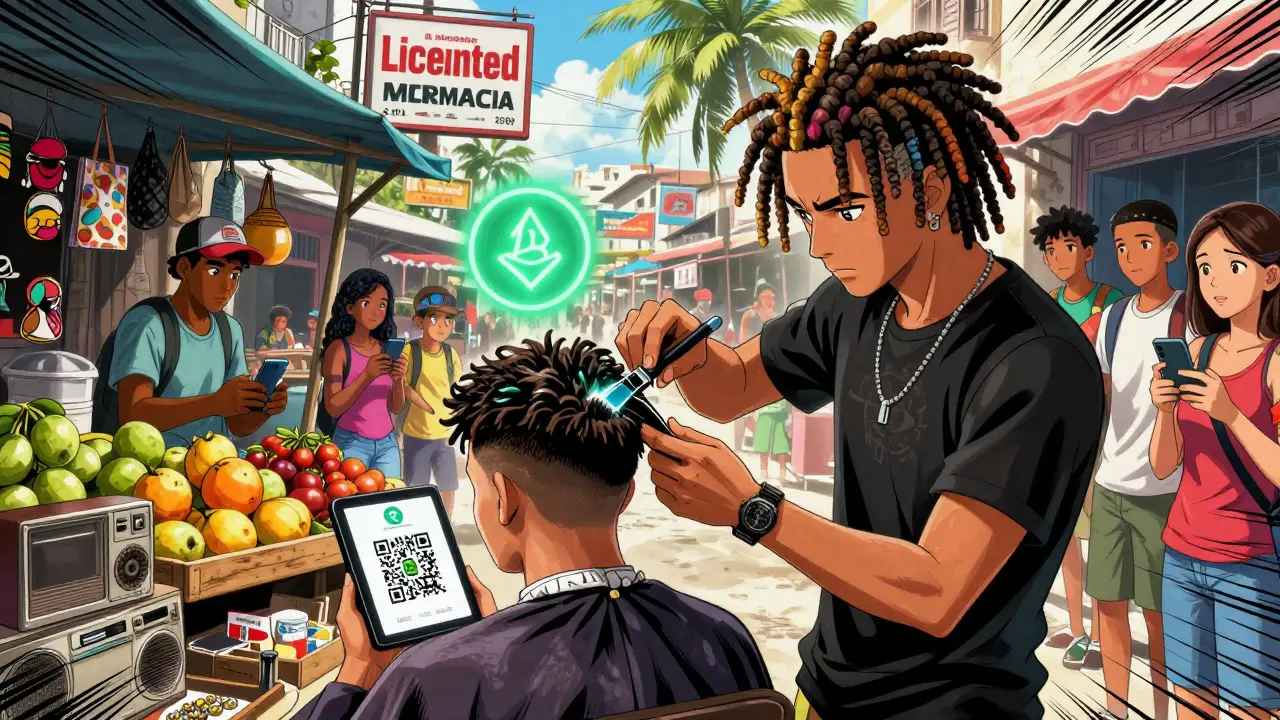

Today, businesses in Cuba can legally accept cryptocurrency - but only if they get a license from the Central Bank. The bank checks each applicant for compliance with anti-money laundering (AML) rules. They must verify customer identities, report suspicious activity, and keep detailed records. Licenses are granted for one year at a time and can be renewed. It’s not free or easy. There’s paperwork, fees, and oversight. But it’s legal. And that’s the key difference from countries like China, which outright banned crypto. Cuba chose regulation over prohibition.Who’s Using It and Why

About 100,000 to 200,000 Cubans - roughly 1% to 2% of the population - use cryptocurrency regularly. That might sound small, but consider this: mobile internet only became widely available in Cuba in 2018. A decade ago, most people didn’t even have smartphones. The main uses are simple and urgent:- Receiving money from relatives in the U.S. or Spain

- Paying for online shopping (Amazon, eBay, international retailers)

- Buying local services from other individuals - like a mechanic or a tutor - without using a bank

- Getting around U.S. sanctions that freeze Cuban assets and block access to global financial systems

Why the U.S. Sanctions Made This Necessary

The U.S. embargo on Cuba began in 1962. It’s one of the longest-running sanctions in modern history. Under the Cuban Assets Control Regulations (31 CFR 515.101-515.901), American companies can’t do business with Cuba. Cuban citizens can’t open U.S. bank accounts. Credit cards issued by American banks don’t work there. Even wire transfers through Western Union were cut off. This isn’t just inconvenient. It’s crippling. A Cuban doctor earning 40 CUP (about $1.50) a month can’t pay for a $50 online course or buy a $200 laptop. But if someone sends $50 in Bitcoin? That’s usable. No bank approval needed. No middleman taking 10% in fees. Cuba didn’t adopt crypto because it loved blockchain technology. It adopted it because it had no other choice.How It Compares to Other Countries

Most nations either ban crypto (China, Egypt) or treat it as a speculative asset (U.S., Japan, Germany). Cuba is different. It treats crypto as infrastructure - like electricity or water. Here’s how it stacks up:| Country | Crypto Status | Primary Motivation | Regulatory Body |

|---|---|---|---|

| Cuba | Legal with licensing | Survival under sanctions | Central Bank of Cuba |

| China | Illegal for transactions | Control over capital flow | People’s Bank of China |

| United States | Legal, unregulated in parts | Financial innovation | SEC, FinCEN |

| El Salvador | Legal tender | Financial inclusion | Ministry of Finance |

Challenges Still Facing Users

Even with legal recognition, crypto in Cuba isn’t perfect.- Internet access: Only about 70% of Cubans have regular mobile internet. Speeds are slow. Data is expensive.

- Licensing hurdles: Getting a business license takes months. Many small operators still work informally, risking fines.

- Education gap: Most people don’t understand wallets, private keys, or cold storage. Scams are common.

- Exchange limits: Licensed exchanges are few. Conversion rates can be volatile.

What’s Next for Cuba’s Crypto Scene

The Central Bank continues to issue new licenses. No signs of reversal. No talk of banning. In fact, officials have hinted at expanding the system to include stablecoins pegged to the U.S. dollar or euro - a move that could make crypto even more practical for everyday use. Experts believe Cuba’s approach could become a blueprint for other countries under sanctions - Venezuela, Iran, North Korea. If a nation can’t access SWIFT, PayPal, or Visa, crypto might be the only way to stay connected to the global economy. The U.S. sanctions won’t disappear overnight. But as long as they stay, Cuba will keep using crypto - not as a rebellion, but as a tool. And that’s the real story.Is cryptocurrency illegal in Cuba?

No, cryptocurrency is not illegal in Cuba. Since August 2021, it has been legally recognized as a payment method under Resolution 215. The government regulates it through the Central Bank of Cuba, requiring businesses to obtain licenses before accepting crypto. Individuals can use it freely for personal transactions.

Why did Cuba allow cryptocurrency?

Cuba allowed cryptocurrency because U.S. sanctions blocked access to global financial systems. Western Union closed its Cuban offices in 2020, credit cards don’t work, and banks refuse to process Cuban transactions. Crypto became the only reliable way for families to send money, buy goods online, and pay for services. The government chose to regulate it rather than ignore it.

Can I use Bitcoin to pay for things in Cuba?

Yes, but only if the business has a license from the Central Bank of Cuba. Some restaurants, online shops, and service providers accept Bitcoin and Ethereum. Most everyday transactions still use cash or the Cuban peso, but crypto use is growing, especially among younger people and those with family abroad.

How many Cubans use cryptocurrency?

Estimates suggest between 100,000 and 200,000 Cubans use cryptocurrency regularly. That’s about 1% to 2% of the population. Given that mobile internet only became common in 2018, this is rapid adoption. Most users rely on Bitcoin, Ethereum, and Avalanche for remittances and online purchases.

Is Cuba’s crypto system similar to El Salvador’s?

No. El Salvador made Bitcoin legal tender - meaning businesses must accept it. Cuba doesn’t require acceptance. Instead, it allows crypto as a licensed payment option. Cuba’s goal is to bypass sanctions, not replace its currency. El Salvador wanted financial innovation. Cuba wanted survival.

Are there crypto exchanges in Cuba?

Yes, but they’re limited and regulated. The Central Bank of Cuba licenses only a few virtual asset service providers. These exchanges allow users to convert Cuban pesos to Bitcoin or Ethereum and vice versa. They must follow strict AML rules. Unlicensed exchanges operate illegally and carry high risk.

Can Americans send crypto to Cuba?

Technically, U.S. sanctions make it illegal for Americans to send crypto to Cuba under the Cuban Assets Control Regulations. However, enforcement is difficult. Many Americans still send crypto through peer-to-peer platforms or third-party services. The Cuban government doesn’t block incoming crypto - it just doesn’t recognize U.S. financial ties as legal.

Will Cuba ban crypto in the future?

There’s no indication Cuba will ban crypto. The government sees it as a necessary tool to work around sanctions. The Central Bank continues to issue licenses and refine rules. Banning it would cut off a vital financial channel for millions of Cubans. The trend is toward more regulation, not less.

Comments

Rishav Ranjan

December 25, 2025 AT 15:12 PMCuba didn't ban crypto. They just made it legal so people don't starve. Simple.

chris yusunas

December 25, 2025 AT 20:58 PMMan, this is wild. Imagine having to use Bitcoin to buy medicine for your kid because your country’s been cut off from the world. Cuba’s not chasing hype-they’re chasing survival. Respect.

Sophia Wade

December 26, 2025 AT 15:30 PMThe philosophical underpinning here is fascinating: when institutional infrastructure collapses, decentralized alternatives emerge not as ideological victories, but as biological necessities. Cuba’s regulatory framework is an organic adaptation to systemic exclusion-not a policy choice, but a survival algorithm.

SHEFFIN ANTONY

December 27, 2025 AT 18:33 PMOh please. It's just another socialist loophole. They're not 'regulating' crypto-they're just trying to tax it without admitting they're broke. And don't give me that 'survival' nonsense. If they weren't so busy being dictator-y, they'd fix their economy instead of gambling on crypto.

Zavier McGuire

December 28, 2025 AT 01:38 AMSo americans can send crypto but its illegal? Sounds like the usual us hypocrisy. I mean if you cant send money to your family but its technically possible... well guess what. People do it anyway. No one cares about your sanctions when your cousin needs insulin

Jordan Renaud

December 29, 2025 AT 20:15 PMIt’s beautiful how necessity breeds innovation. Cuba didn’t wait for permission-they found a way. And honestly? That’s what freedom looks like. Not waving flags. Just figuring out how to keep your family fed when the world says no.

Luke Steven

December 31, 2025 AT 16:25 PMThis is the quiet revolution no one talks about. Not blockchain hype. Not NFTs. Just a mom in Havana converting BTC to cash so her son gets his meds. That’s the real utility. Tech isn’t about decentralization-it’s about dignity. And Cuba’s getting it right.

Ellen Sales

January 1, 2026 AT 14:58 PMso like... cuba lets crypto but us says its illegal to send it? lmao. sounds like the us is mad they cant control the flow of money anymore. also i think the cubans are just like 'we dont care what your laws say, we need to eat' 🤷♀️

Sheila Ayu

January 2, 2026 AT 23:23 PMWait, wait, wait-so you're saying that a country under U.S. sanctions is using cryptocurrency as a financial lifeline, and you're calling it 'regulation'? That's not regulation-that's desperation! And you're glorifying it?! What about the risks? The scams? The lack of consumer protection?! This is dangerous! And why are you ignoring the fact that this could be exploited by drug cartels?!

Janet Combs

January 3, 2026 AT 01:10 AMi never thought about it like this but like... if you cant use paypal and your family sends you money and you need to buy stuff... yeah crypto makes sense. its not cool tech, its just... how you live now. kinda sad but also kinda cool? 🤔

Dan Dellechiaie

January 3, 2026 AT 20:29 PMLet me break this down for the amateurs: Cuba’s crypto policy is a direct consequence of imperialist economic warfare. The U.S. embargo is a form of state terrorism. Crypto is the decentralized counterinfrastructure. This isn't about 'innovation'-it's about resistance. And the fact that they're licensing exchanges? That's state-level pragmatism. You're welcome.

Radha Reddy

January 5, 2026 AT 10:22 AMIt is remarkable how a nation, despite enduring prolonged economic constraints, has managed to integrate modern financial tools with such measured intent. The Central Bank’s approach reflects a deep understanding of both technological potential and social responsibility. One cannot help but admire this balance.

Shubham Singh

January 5, 2026 AT 12:59 PMLet’s be honest: this is not ‘regulation.’ It’s a Band-Aid on a gunshot wound. Any government that forces its citizens into crypto because it can’t provide basic banking services is not progressive-it’s incompetent. And now they’re pretending this is a model? Please.

Charles Freitas

January 6, 2026 AT 15:47 PMOh great. Another ‘crypto saves the oppressed’ story. Meanwhile, the same people who love this narrative scream about ‘decentralization’ when it suits them, but then cheer when a government controls it. Hypocrites. Also, 2% of the population? That’s not adoption. That’s a niche for tech bros and scammers.

Aaron Heaps

January 7, 2026 AT 09:34 AM100k users in a country of 11M? That’s 0.9%. And you call this a lifeline? The real story is that most Cubans still use cash because crypto is too slow, too expensive, and too risky. This article is just woke propaganda dressed up as economics.

Tristan Bertles

January 8, 2026 AT 01:30 AMThis is one of those rare cases where the real hero isn’t the tech-it’s the people. The barber in Santiago. The mom in Havana. The uncle in Miami sending BTC instead of wires. They didn’t wait for permission. They just did what had to be done. And that? That’s the future. Not the blockchain. The humans.