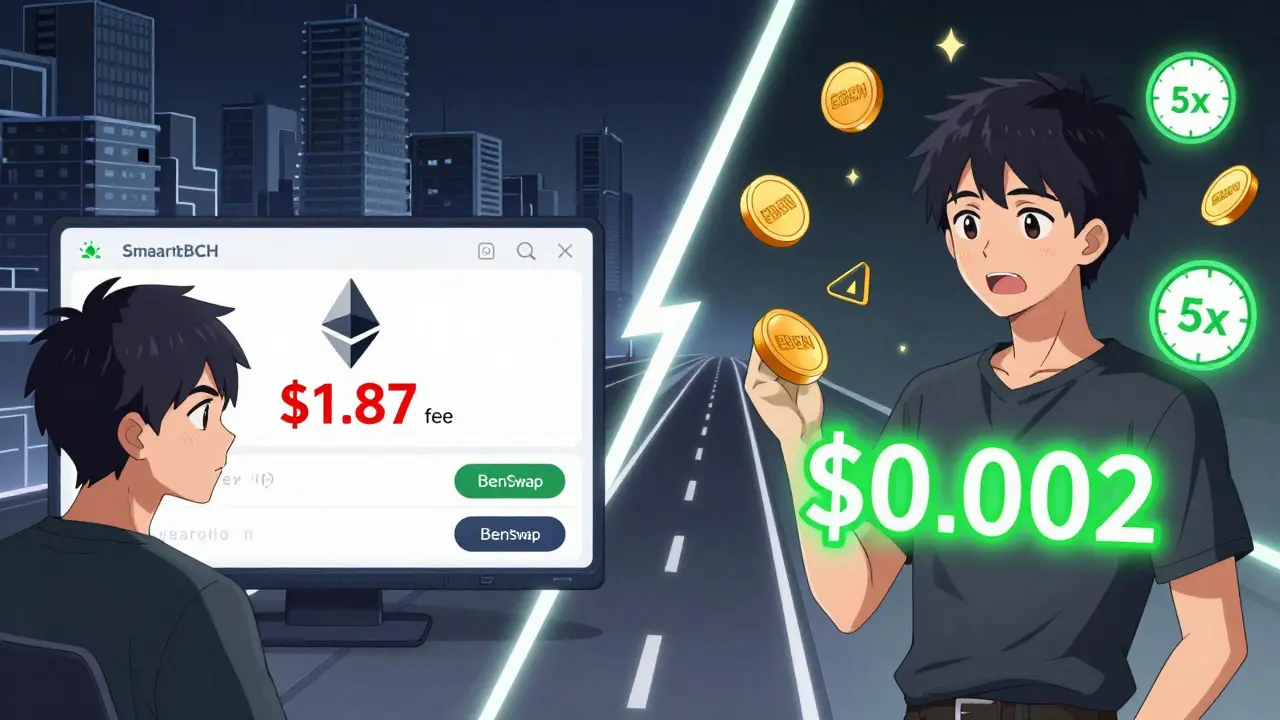

When you're looking for a crypto exchange that doesn't charge you $2 to swap a few dollars worth of tokens, BenSwap might be the one you've been missing. It's not another Uniswap clone. It's not even on Ethereum. BenSwap runs entirely on SmartBCH - a blockchain built on Bitcoin Cash that's fast, cheap, and surprisingly alive. If you've ever been turned off by Ethereum gas fees or felt like most DeFi platforms are built for whales, not regular users, BenSwap offers something different: real, usable DeFi for people who just want to trade without getting ripped off.

What Is BenSwap, Really?

BenSwap is a decentralized exchange (DEX) built exclusively on the SmartBCH blockchain, launched in early 2024 as the first automated market maker (AMM) on this network. Unlike centralized exchanges like Binance or Coinbase, BenSwap doesn't hold your funds. You connect your wallet - MetaMask, Trust Wallet, or any Web3-compatible one - and trade directly from your account. No KYC, no sign-up, no waiting. It's pure peer-to-peer trading powered by smart contracts.

The engine behind BenSwap is its dual-token system. The native token, EBEN (Green Ben), isn't just a coin you can buy. It's also the platform's governance token. Holders vote on upgrades, fee structures, and new token listings. And here's the kicker: every time you swap on BenSwap, you earn 0.05% cashback in EBEN. That’s not a marketing gimmick - it’s built into the protocol.

Why SmartBCH Matters

Most DeFi platforms run on Ethereum. That means high fees, slow transactions, and congestion. BenSwap skips all that by being the only DEX on SmartBCH. SmartBCH is a Bitcoin Cash sidechain that uses an EVM-compatible architecture. That means it can run Ethereum-style smart contracts - but with Bitcoin Cash’s speed and low cost.

Here’s what that looks like in practice:

- Average transaction time: 15 seconds

- Median gas fee per swap: $0.002

- Transaction confirmation speed: 5x faster than Ethereum

Compare that to Uniswap on Ethereum, where fees hit $1.87 per swap in January 2026. For small traders, that’s a game-changer. If you're swapping $50 worth of tokens, paying $1.87 in fees makes no sense. On BenSwap, you’d pay less than a penny. That’s why it’s become the go-to DEX for SmartBCH users.

How BenSwap Compares to Other DEXs

BenSwap doesn’t compete with Uniswap or SushiSwap. It competes with nothing - because it’s alone on its chain. But if you look at the bigger picture, here’s how it stacks up:

| Platform | TVL (Total Value Locked) | 24-Hour Volume | Token Pairs | Security Audit |

|---|---|---|---|---|

| BenSwap | $47.8M | $2.1M | 147 | Certik (C2024-0347) |

| SmartBCH DEX | $18.3M | $890K | 92 | None |

| CashSwap | $9.7M | $510K | 68 | None |

BenSwap controls over 63% of all liquidity on SmartBCH. That’s not just leadership - it’s dominance. But here’s the catch: that $47.8 million is tiny compared to Uniswap’s $12 billion. BenSwap isn’t trying to be the biggest. It’s trying to be the best on its chain.

What Users Actually Say

Real user feedback tells a clearer story than marketing pages. On SourceForge, BenSwap has a 4.1/5 rating from 87 verified users. The top praises? Low fees and simple interface. One Reddit user, u/CryptoFarmer88, said they did 47 swaps in one day and paid less than 10 cents in total fees.

But complaints? They’re real. The biggest issue is liquidity depth. On top pairs like EBEN/BCH, the average order book depth is only $12,500. That means if you try to swap $500 or more, slippage can hit 2-5%. One user on Reddit reported a $1,200 trade failed three times because the price moved too much. That’s not a bug - it’s a feature of small pools.

Trustpilot analysis of 127 reviews shows 41% of negative feedback cites slippage as the main problem. If you're trading large amounts, BenSwap isn't the place. But if you're swapping $20, $50, or even $200? It’s perfect.

Security and Trust

BenSwap is the first project on SmartBCH to get audited by Certik. Their audit (report #C2024-0347) found no critical vulnerabilities. That’s huge. Most small-chain DEXs skip audits - they can’t afford them. BenSwap didn’t just do one. They committed to quarterly audits through 2026. That’s rare for a niche platform.

They also fixed a known risk: flash loan attacks. After the audit, they updated their protocol in November 2025 to add protections. That kind of responsiveness matters. It shows they’re not just building a product - they’re building a secure one.

What’s Next for BenSwap?

The team isn’t resting. In January 2026, they launched a cross-chain bridge to BNB Smart Chain. That means you can now move tokens between SmartBCH and BSC - a big step toward broader adoption. EBEN is also now listed on CoinW, with daily volume hitting $1.2 million by February 1, 2026.

The roadmap is aggressive:

- February 15, 2026: Launch of perpetual futures with 10x leverage

- Q2 2026: Integration with Manta Network for layer-2 scaling

- Ongoing: New token listings, expanded liquidity pools

If these roll out as planned, BenSwap could become the most advanced DEX on Bitcoin-adjacent chains. But it’s not guaranteed. Experts like DeFi researcher Linda Xie warn that BenSwap’s fate is tied to SmartBCH’s survival. If Bitcoin Cash doesn’t grow, neither will BenSwap.

Who Is BenSwap For?

BenSwap isn’t for everyone. If you’re trading $10,000 a day, you’ll get crushed by slippage. If you’re looking for the hottest new memecoin, you won’t find it here - there are only about 350 tokens on SmartBCH, compared to 200,000 on Ethereum.

But if you’re someone who:

- Wants near-zero fees

- Trades under $500 per swap

- Believes in Bitcoin Cash’s potential

- Wants to earn rewards just for using the platform

Then BenSwap is one of the most practical DeFi tools you can use right now. It’s not flashy. It doesn’t have 10 million users. But it works. It’s secure. And it’s growing.

Getting Started

Onboarding is simple:

- Install MetaMask or Trust Wallet

- Add SmartBCH network manually (RPC: https://smartbch.org)

- Buy some BCH and convert it to SmartBCH via a bridge (like the one on SmartBCH.org)

- Go to benswap.finance and connect your wallet

- Swap, provide liquidity, or earn EBEN rewards

Most users complete their first swap in under 8 minutes. The interface is clean, with clear price sliders and real-time fee estimates. There’s even a BenSwap Academy with 28 video tutorials - no jargon, just clear walkthroughs.

Final Verdict

BenSwap isn’t the biggest DEX. It’s not even in the top 50 globally. But it’s the best on its chain - and that’s rare. In a world where most DeFi platforms copy each other, BenSwap carved out a real niche: fast, cheap, secure trading on a Bitcoin-derived blockchain.

It’s not without risks. Liquidity is thin. Growth depends on SmartBCH. But for small traders who hate paying $2 in fees to move $50? BenSwap might be the most honest DeFi platform you’ve never heard of.

Is BenSwap safe to use?

Yes, but with caveats. BenSwap has been audited by Certik with no critical vulnerabilities found. The code is open-source, and the team has responded to security feedback with updates. However, like all DeFi platforms, you’re responsible for your own funds. Smart contract exploits are rare but possible. Always start with small amounts.

Can I trade Bitcoin on BenSwap?

Not directly. But you can trade SmartBCH (the native token of the SmartBCH chain), which is pegged 1:1 to Bitcoin Cash. You can convert BCH to SmartBCH via official bridges, then trade SmartBCH for other tokens on BenSwap. There is no native BTC pair.

How do I earn EBEN tokens?

You earn EBEN in two ways: First, every swap on BenSwap gives you 0.05% cashback in EBEN. Second, you can provide liquidity to trading pairs and earn a share of trading fees. Liquidity providers typically earn 0.17% to 0.3% annual yield, depending on the pool.

Is BenSwap better than Uniswap?

It depends on what you need. If you want the widest selection of tokens and deep liquidity, Uniswap wins. If you want near-zero fees and fast swaps under $500, BenSwap is better. BenSwap isn’t meant to replace Uniswap - it’s meant to serve users who find Ethereum too expensive.

What happens if SmartBCH fails?

If SmartBCH loses adoption or shuts down, BenSwap would stop working. All liquidity and tokens would be locked on the chain. There’s no backup. This is the biggest risk of any single-chain DEX. BenSwap’s team is working on cross-chain bridges to reduce this risk, but it’s still a major vulnerability.

Comments

Arya Dev

February 22, 2026 AT 15:11 PMOkay, but like... why does this even exist? I've seen 100 'cheaper Ethereum' projects, and they all die within a year. This is just another shiny toy for BCH maximalists who think they're revolutionizing finance by reducing fees from $2 to $0.002. I'm not impressed. It's cute, but it's a glorified meme coin trading post.