When Vietnam officially legalized cryptocurrencies in June 2025, it didn’t throw open the doors. Instead, it built a locked gate with a very specific key. The State Bank of Vietnam (SBV) didn’t just change its mind-it redesigned the entire system around control. Bitcoin and Ethereum are now recognized as virtual assets, but you can’t use them to buy coffee, pay rent, or settle business invoices. That’s still illegal. What you can do is trade them on licensed platforms… if you can even find one.

What Changed in 2025?

Before 2025, the SBV was clear: no crypto payments, no bank involvement, no gray zones. Financial institutions were banned from handling any crypto-related transactions. If you bought Bitcoin, you did it on your own-no bank transfers, no local exchanges, just peer-to-peer deals over apps like Binance P2P. It was a thriving underground market, with Vietnam ranking fourth globally in crypto adoption in 2025, according to Chainalysis. Over 20% of tech-savvy Vietnamese people owned digital assets, even without legal support. The shift came with the Law on Digital Technology Industry and Resolution No. 05/2025/NQ-CP. These documents didn’t just permit crypto-they created a tightly controlled sandbox. Virtual assets are now legal property. You can own them, inherit them, sell them. But you can’t treat them like money. The SBV drew a hard line: crypto is an asset, not a currency.The Five-Year Pilot: Who Can Operate?

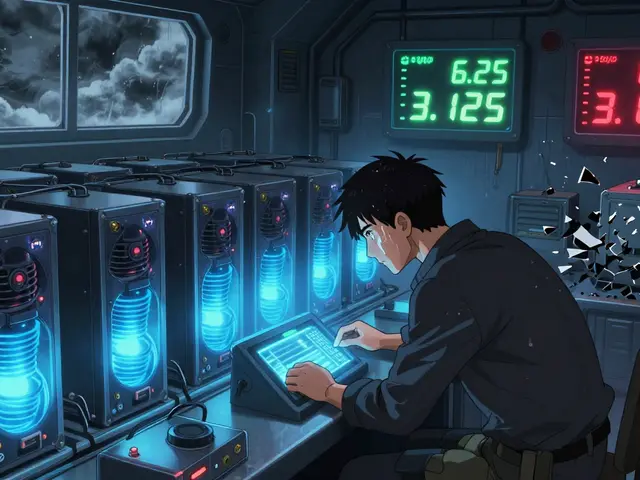

The centerpiece of Vietnam’s new policy is a five-year pilot program that launched in September 2025. It’s not a free-for-all. Only five licensed exchanges are allowed to operate. And they can’t just open up shop. To get licensed, a company needs:- At least 10 trillion Vietnamese dong in capital-roughly $379 million USD

- At least two shareholders from approved sectors: commercial banks, securities firms, insurers, fund managers, or tech enterprises

- Proof that those shareholders have been profitable for two straight years

- Only Vietnamese dong trading pairs-no USDT, no BTC/USD, no foreign currency pairs

Why So Restrictive?

The SBV isn’t anti-innovation. It’s anti-risk. Deputy Governor Pham Thanh Ha has said the goal is to "integrate digital assets into the financial ecosystem while maintaining control." That means:- No stablecoins backed by USD or other fiat currencies-those are banned

- No tokenized securities-those fall under the Ministry of Finance’s jurisdiction

- All transactions must be settled in Vietnamese dong

- All crypto exchanges must use the government’s NDAChain blockchain for transaction logging

How Are People Still Trading?

Despite the rules, crypto trading hasn’t slowed down-it’s just gone underground. Peer-to-peer trading on Binance P2P and local platforms like Remitano is still massive. People use cash deposits, bank transfers (disguised as "goods payments"), and even QR code-based mobile wallets to move value. The SBV knows this. They don’t chase individuals. They’re focused on institutions. Foreign investors can’t trade directly on Vietnamese exchanges. But if they go through a Ministry of Finance-approved Crypto Asset Service Provider (CASP), they can access the licensed platforms. It’s a two-tier system: locals trade on regulated exchanges, foreigners trade through government-approved intermediaries.How Does This Compare to Neighbors?

Singapore lets you issue stablecoins. The Philippines lets crypto firms operate with minimal capital. Thailand allows crypto as a payment method in select sectors. Vietnam? It’s the opposite. It’s the most restrictive in Southeast Asia. That’s intentional. While other countries race to attract crypto firms, Vietnam is trying to build a controlled, domestic ecosystem. The trade-off is clear: high barriers mean slower growth, but less risk of financial chaos. The SBV isn’t worried about losing out to Singapore. It’s worried about losing control of its currency.

What’s Next?

The pilot runs until 2030. By then, the SBV will decide whether to expand licensing, lower capital requirements, or shut it down entirely. The fact that no companies have applied yet suggests either the rules are too tight-or the market isn’t ready. One thing is certain: Vietnam won’t go back to banning crypto. The legal recognition of virtual assets as property is permanent. The question is whether the government will loosen the leash-or tighten it further. For now, if you’re a Vietnamese citizen with Bitcoin, you can hold it. You can sell it. You can even use it as collateral-if you find a bank willing to accept it. But you can’t spend it. And you can’t trade it on a real exchange… because none are open yet.What This Means for You

If you’re an investor: don’t expect quick returns. The market isn’t liquid. The exchanges aren’t live. The legal framework is real, but inactive. If you’re a trader: stick to P2P. It’s the only functioning market. If you’re a business: wait. Don’t waste time applying for a license until at least one firm succeeds. The rules might change in 2027. If you’re a policymaker: Vietnam’s model is being watched. It’s not a blueprint for adoption. It’s a blueprint for control.Is cryptocurrency legal in Vietnam in 2026?

Yes, but only as a virtual asset-not as money. You can own, trade, and inherit Bitcoin and Ethereum under Vietnamese law, but you cannot use them to pay for goods or services. Using crypto as payment remains illegal.

Can I open a crypto exchange in Vietnam?

Technically yes, but no company has applied yet. To qualify, you need at least 10 trillion VND ($379M) in capital, two profitable shareholders from approved sectors, and you must trade only in Vietnamese dong. The government limits licensing to five exchanges total.

Are stablecoins like USDT allowed in Vietnam?

No. Stablecoins backed by fiat currencies like the US dollar are explicitly banned under Resolution No. 05/2025/NQ-CP. Only virtual assets backed by real physical assets (like gold or commodities) are permitted, and even then, only through licensed platforms.

Can foreigners trade crypto in Vietnam?

Only through Ministry of Finance-approved Crypto Asset Service Providers (CASPs). Direct access to Vietnamese crypto exchanges is restricted to Vietnamese-owned and funded companies. Foreign investors cannot open accounts on local exchanges.

Why hasn’t any company applied for a license yet?

The capital requirement of 10 trillion VND ($379M) is extremely high for the region. Many local firms lack the resources, and international players are blocked by ownership rules. There’s also uncertainty about long-term profitability under strict trading restrictions.

Is the State Bank of Vietnam against innovation?

No. The SBV launched NDAChain, a government-controlled blockchain for tokenizing bonds and carbon credits. They want innovation-but only under strict oversight. Their goal isn’t to stop crypto; it’s to make sure it serves Vietnam’s economy, not bypasses it.