What Happens to Miners When Bitcoin Halves?

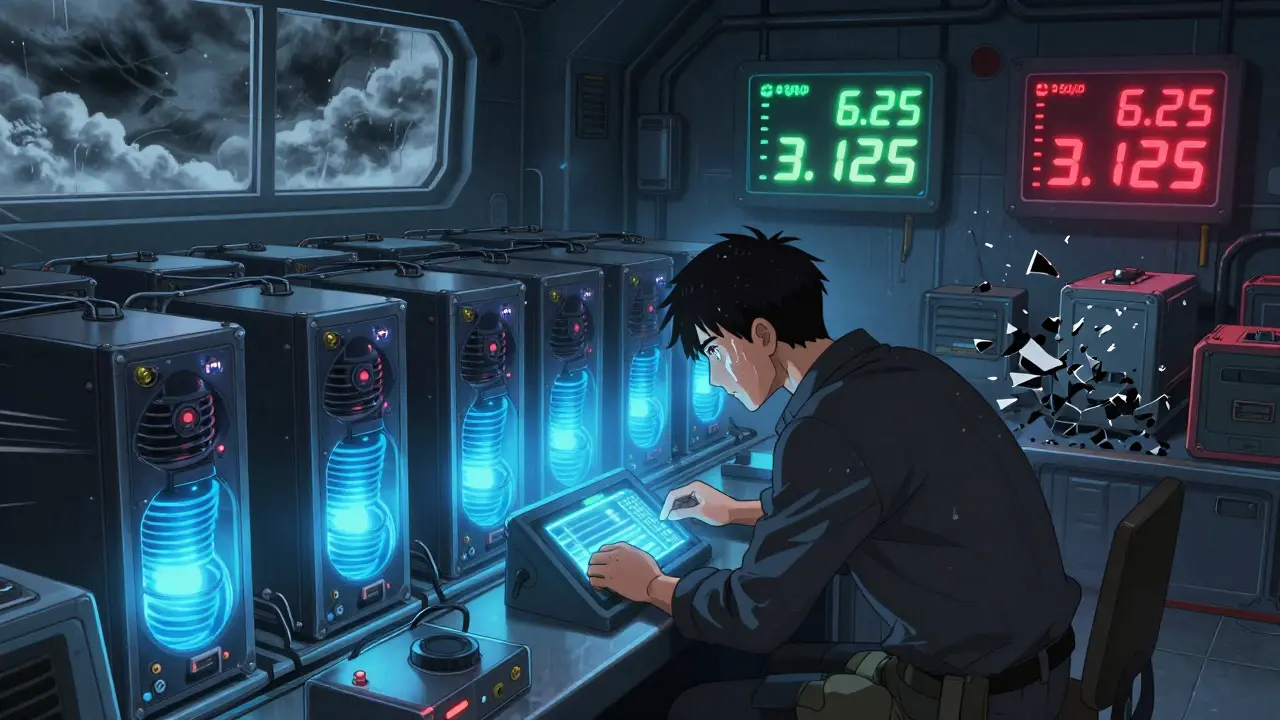

Every four years, Bitcoin cuts its block reward in half. That means miners-people and companies running powerful computers to secure the network-get exactly half the Bitcoin they used to earn for each block they mine. The last time this happened was April 20, 2024. Before that, miners got 6.25 BTC per block. After, they got 3.125 BTC. No more, no less. It’s not a suggestion. It’s code. And for miners, it’s a make-or-break moment.

Miners don’t just mine for fun. They do it to make money. Their income comes from two places: the block reward (new Bitcoin created) and transaction fees (payments users add to get their transactions confirmed). Before the 2024 halving, block rewards made up 98% of miner revenue. Transaction fees? Barely 2%. That means if the price of Bitcoin doesn’t go up after a halving, miners suddenly lose nearly half their income-with no warning.

The Immediate Shock: Production Drops, Profit Margins Shrink

Right after the April 2024 halving, mining companies saw their Bitcoin output plummet. Bitdeer’s production dropped 31%. Marathon Digital lost 28%. Iris Energy, Cleanspark, Bitfarms-all saw 20% to 25% declines. Why? Because the math didn’t change. The same machines, same electricity, same hardware-but now half the Bitcoin output. It’s like getting paid $10 an hour instead of $20 for the same job.

For small miners with old equipment and expensive power, it was a death sentence. One miner on Reddit, ‘MiningGuru87,’ shut down 40% of his Antminer S19j Pro rigs after the halving. His break-even price jumped from $28,000 to $49,000 overnight. That’s not a guess. That’s cold, hard math. If Bitcoin stays below $49,000, he loses money every hour his machines run.

Electricity cost is the biggest factor. Miners paying less than $0.04 per kWh can still profit even if Bitcoin drops to $35,000. Those paying $0.08 or more? They need Bitcoin to hit $50,000 just to break even. In places like Texas or Kazakhstan, where power is cheap, miners thrived. In Europe or California, where grid power costs $0.10 or more, many just turned off their rigs.

The Great Sorting: Who Survives, Who Doesn’t

Halvings don’t hurt everyone equally. They sort miners into winners and losers. The ones who survive are the ones who planned ahead.

- Efficient miners upgraded to newer ASICs (like the Antminer S21 or WhatsMiner M50S) that use less power per hash. These machines can mine profitably even with lower rewards.

- Energy-savvy miners moved to places with stranded power-hydroelectric dams in Canada, flared gas sites in Texas, or geothermal plants in Iceland. Some are now paying as little as $0.015 per kWh.

- Well-funded miners kept cash reserves. Fidelity Digital Assets recommends having at least six months of operating expenses in fiat or stablecoins. That’s the buffer that lets you wait out the price slump.

Meanwhile, the losers? They’re gone. Compute North went bankrupt in 2022-before the halving-but their collapse was a warning sign. After April 2024, dozens of smaller operations followed. The Bitcoin Mining Council reported that 17% of miners sold equipment to raise cash. Another 23% signed load-shedding deals with utilities, turning off rigs during peak electricity hours.

Consolidation Is Now the Norm

The mining industry isn’t just shrinking-it’s consolidating. In the six months after the halving, major mining companies spent $1.2 billion buying up competitors. The top 10 mining pools now control 65% of the global hash rate, up from 58% in early 2024. That’s not just business-it’s survival.

Why? Because mining isn’t a hobby anymore. It’s a capital-intensive industry. You need millions to buy thousands of machines, secure long-term power contracts, and maintain cooling systems. Small miners with a few dozen rigs can’t compete. They’re being absorbed-or forced out.

Even big players are adapting. Iris Energy, for example, installed immersion cooling systems that cut energy use by 18%. That allowed them to stay profitable even when Bitcoin dipped below $32,000. Others are repurposing their hardware for AI computing. Iris Energy signed a $200 million deal to rent out its idle compute power to an AI startup. That’s not mining anymore-it’s diversified infrastructure.

Security Risks and the Fee Transition

When miners shut down, the network’s total hash rate drops. After the 2024 halving, Bitcoin’s hash rate fell from 735 EH/s to under 600 EH/s in May. That’s a 18% drop. That’s a security risk.

Why? Because Bitcoin’s security relies on how much computational power is defending it. If hash rate falls too far, a single entity could theoretically control more than half the network and launch a 51% attack-double-spending coins, reversing transactions. LSEG warned that if Bitcoin’s price doesn’t recover, fewer miners could mean a less secure network.

That’s why everyone’s watching transaction fees. Right now, they’re still tiny-under 5% of miner income. But after the next halving in 2028, block rewards will drop to 1.5625 BTC. At that point, transaction fees need to make up at least 35% of miner revenue to keep the network secure. That’s a massive shift.

There’s a glimmer of hope. In May 2024, BRC-20 token inscriptions spiked. Transaction fees jumped 37% month-over-month, briefly contributing 6.8% to miner revenue. It wasn’t enough to save everyone, but it showed that user activity can boost fees. If Bitcoin becomes a more active settlement layer, fees could grow. But that’s not guaranteed.

The New Mining Playbook

Miners today don’t just run machines. They’re energy traders, engineers, and financial strategists.

- Hardware refresh cycles have shrunk from 24 months to 14 months. You can’t keep old rigs anymore.

- DC power infrastructure is now standard. It cuts conversion losses by 8-12%, saving hundreds of thousands a year.

- Heat reuse is common. Some mining farms now heat greenhouses, office buildings, or even swimming pools.

- Energy contracts are negotiated like hedge funds. Miners lock in fixed rates for 5-10 years to avoid price spikes.

And the learning curve? Steep. You need to understand power grids, thermal dynamics, and financial hedging. You can’t just buy a rig and plug it in anymore.

What’s Next? The 2028 Halving and Beyond

The next halving is scheduled for August 2028. By then, block rewards will be down to 1.5625 BTC. If Bitcoin’s price doesn’t rise significantly by then, the industry could permanently lose 15-20% of its mining capacity, according to the Bitcoin Mining Council.

But the network is adapting. Energy use per Bitcoin transaction has dropped from 1,544 kWh in 2021 to 782 kWh in June 2024. That’s a 50% improvement. Miners are getting cleaner, smarter, and leaner. The halving isn’t a disaster-it’s a forced evolution.

Miners who treat this like a cycle of renewal will survive. Those who treat it like a crisis? They’ll disappear. The Bitcoin network doesn’t care how much you invested. It only cares if your machines are running, your power is cheap, and your balance sheet can hold out.

Comments

Katherine Melgarejo

January 18, 2026 AT 06:31 AMSo miners are basically just glorified electricity farmers now? 🤷♀️ One guy pays $0.015/kWh and laughs while others cry over their $0.10 bills. Welcome to capitalism, folks.

Bill Sloan

January 19, 2026 AT 17:31 PMI saw a miner in Texas turn his rig’s waste heat into a greenhouse for tomatoes. Tomatoes AND Bitcoin? That’s the future right there. 🌱💰

Sarah Baker

January 19, 2026 AT 21:31 PMI know people say Bitcoin mining is evil, but have you seen how many farms are using stranded gas or hydro? We’re turning waste into value. This isn’t just mining-it’s innovation.

Stephen Gaskell

January 21, 2026 AT 10:42 AMIf you can't afford to mine here, go to China. We don't need your energy-hogging rigs in America.

Alexandra Heller

January 22, 2026 AT 18:35 PMThe real tragedy isn't the halving-it's that we've turned a decentralized dream into a Wall Street power play. Miners aren't guardians anymore. They're corporate assets. We sold our soul for efficiency.

myrna stovel

January 24, 2026 AT 16:24 PMTo everyone who thinks small miners are dead: don’t count them out. I know a guy in rural Oregon running three S19s off a solar array and a backup battery. He doesn’t need to be big to be right. You don’t need millions to believe in the vision.

Patricia Chakeres

January 26, 2026 AT 00:26 AMOf course the big players are consolidating. It’s all part of the Fed’s plan to control the narrative. They want you to believe Bitcoin is just another commodity. But the code doesn’t lie. The halving is a reset. They can’t control that.

Telleen Anderson-Lozano

January 27, 2026 AT 22:55 PMI mean, it’s not just about the hardware, right? It’s about the mindset. You have to think like a hedge fund manager, an electrical engineer, AND a heat-recycling entrepreneur. And if you don’t? You’re not a miner-you’re a liability. And that’s not just harsh-it’s true.

Liza Tait-Bailey

January 29, 2026 AT 08:57 AMI just turned off my 4 S19s last week. Can't afford the power bill anymore. But hey, I still hold my BTC. Maybe I'll buy new ones when the price hits $100k. Fingers crossed 😅

Pat G

January 29, 2026 AT 14:40 PMThis is why we need to ban foreign mining operations. They're stealing our energy, our jobs, our future. And now they're telling us to just "adapt"? No. We need borders. We need rules.

Christina Shrader

January 31, 2026 AT 00:53 AMThe fact that BRC-20 fees spiked after the halving? That’s the network waking up. People are using it. The fees will grow. Just wait. This isn’t the end-it’s the beginning of phase two.

Kelly Post

January 31, 2026 AT 03:47 AMI’ve been mining since 2017. I’ve seen three halvings. The first one? Chaos. The second? Recovery. The third? Consolidation. This one? Evolution. Every time, the network gets stronger. The miners who survive aren’t lucky-they’re prepared. And if you’re reading this and still running an S9? You’re not a miner. You’re a museum piece.

Haley Hebert

February 1, 2026 AT 18:28 PMI think the real win here isn't the money-it's the resilience. The network didn't break. The code held. People adapted. That’s the beauty of Bitcoin. It doesn't need us. We need it. And that’s why it’ll outlast every government, every bank, every hype cycle.