As of 2026, crypto mining in Pakistan is no longer a gray-area activity - it’s a regulated industry with clear rules, taxes, and infrastructure backing. Just two years ago, miners operated in the shadows, fearing raids or bank account freezes. Today, the government has opened the door - but with strict conditions. If you’re thinking about starting or expanding a mining operation in Pakistan, here’s what actually matters.

Electricity Allocation: The Core of Pakistan’s Mining Strategy

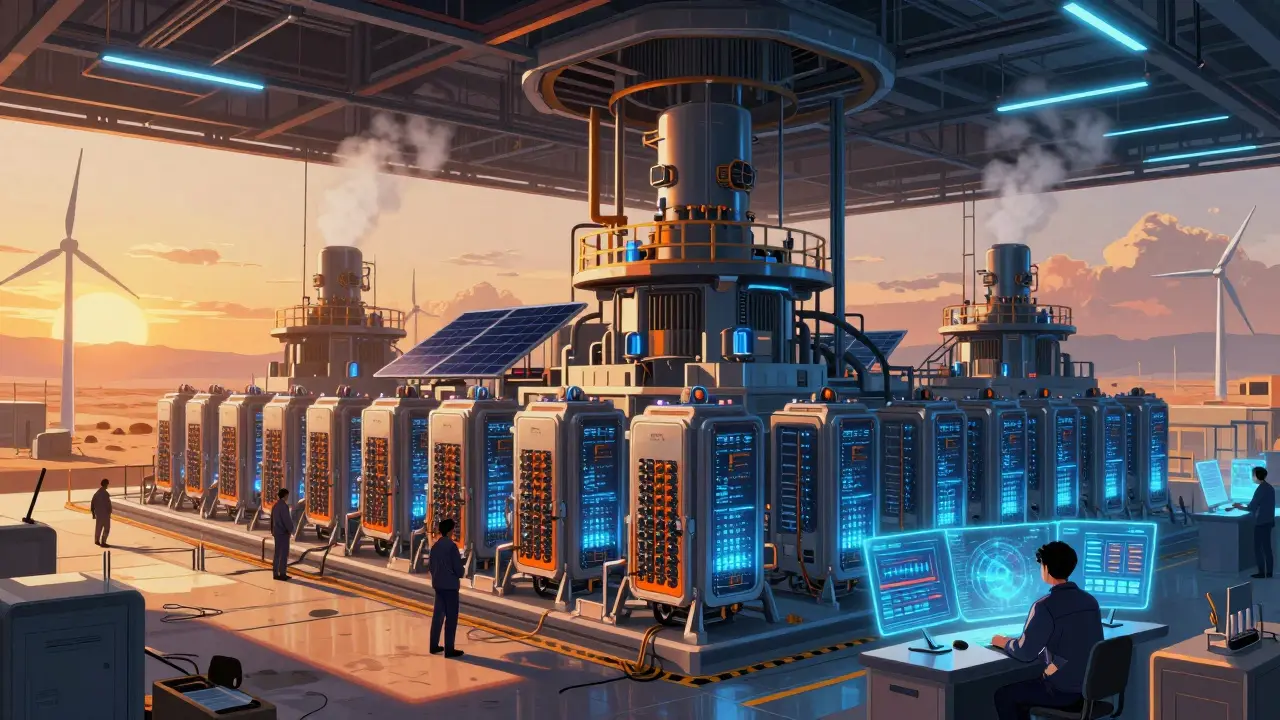

The biggest shift came in August 2025, when the government allocated 2,000 megawatts (MW) of electricity specifically for crypto mining and AI data centers. This isn’t new power generation - it’s surplus energy from underused coal plants and areas where small businesses have switched to solar to cut costs. Before this, Pakistan contributed almost nothing to the global Bitcoin hash rate. Now, if all that power is used efficiently, experts estimate Pakistan could jump to the top five mining countries worldwide.

Here’s the catch: you can’t just plug in a rig at home. The rules forbid using residential electricity. All mining operations must connect to industrial-grade power lines with a minimum 500 kW capacity. This stops individuals from gaming the system with subsidized home rates. The goal? Use waste energy, not drain the grid.

PVARA: The New Regulator in Charge

In July 2025, Pakistan created the Pakistan Virtual Asset Regulatory Authority (PVARA) an autonomous federal body overseeing all virtual asset activities including mining, trading, and staking. Before PVARA, there was no official regulator - just conflicting signals from the State Bank of Pakistan (which called crypto illegal) and the Pakistan Crypto Council (which encouraged adoption). Now, PVARA is the only legal gateway.

To get licensed, mining operators must submit detailed plans covering:

- Technology specs (ASIC models, hash rate capacity)

- Energy consumption estimates

- Security protocols

- Environmental impact plans

- Compliance with FATF, IMF, and World Bank standards

Foreign companies must already be licensed by regulators like the US SEC, UK FCA, UAE’s VARA, or Singapore’s MAS. This means PVARA isn’t looking for startups - it’s inviting established global players.

Taxation: Mining Income Is Now Officially Taxable

Before 2025, crypto mining income was ignored - or taxed inconsistently. Now, it’s fully integrated into Pakistan’s tax system. All mining profits are treated as regular income and taxed at progressive rates:

- 5% on income up to ₨600,000

- 15% on income between ₨600,001 and ₨1.2 million

- 25% on income between ₨1.2 million and ₨2.4 million

- 30% on income between ₨2.4 million and ₨6 million

- 35% on income over ₨12 million

If you sell mined Bitcoin or other coins, capital gains are taxed at a flat 15%. All mining income must be reported on Form IT-1 by September 30 each year. PVARA shares transaction data with the Federal Board of Revenue (FBR), so hiding income isn’t an option anymore.

Shariah Compliance and Environmental Rules

Pakistan’s regulatory framework includes special provisions for Shariah-compliant mining. This isn’t just symbolic - it’s a real pathway for religiously cautious investors. PVARA runs regulatory sandboxes where operators can test models that avoid interest-based financing, leverage, or speculative trading structures.

Environmental concerns were a major sticking point. To address them, PVARA’s draft guidelines (released August 28, 2025) require mining operations to use at least 70% renewable or repurposed energy by 2027. That means solar, wind, or waste heat from coal plants - not new fossil fuel plants built just for mining.

Who Can Mine? The Two-Phase Licensing Plan

PVARA’s rollout is split into two clear phases:

- Phase 1 (Q3-Q4 2025): Only large international operators with hash rates over 1 exahash per second (EH/s) could apply. These are companies like Bitmain, Core Scientific, or Argo Blockchain.

- Phase 2 (Q1 2026): Domestic miners can now apply - but only if they have at least 100 petahash per second (PH/s) capacity. That’s roughly 1,000 modern ASIC miners running nonstop. Small-scale home miners (1-10 rigs) are still excluded.

This structure makes it nearly impossible for local startups to compete. The goal isn’t to empower Pakistani entrepreneurs - it’s to attract foreign capital and tech expertise.

Contradictions Still Exist

Despite the progress, confusion remains. The State Bank of Pakistan still says digital currencies are not legal tender and that banks can’t deal with them. That means miners can’t open business bank accounts easily. Many use third-party payment processors or crypto-native financial services to move funds - but that creates compliance risks.

In September 2025, Pakistan’s Senate recommended moving the Pakistan Crypto Council from the Ministry of Finance to the Ministry of Information Technology. Why? Because digital assets are more about tech infrastructure than finance. This signals that even within government, there’s no clear consensus on how to manage crypto.

The Bigger Picture: Why Pakistan Is Doing This

Pakistan isn’t just trying to make money from mining. It’s trying to become a tech player. With over 40 million crypto wallets - third-highest in the world after the U.S. and India - the country already has a massive user base. Mining is a way to turn that adoption into economic output.

The $21 billion crypto market in Pakistan isn’t just about speculation. Mining could contribute 15-20% of that value in the next two years. That’s billions in foreign investment, tech jobs, and energy infrastructure upgrades.

It’s also a hedge against economic instability. With inflation, currency devaluation, and banking restrictions, crypto mining gives people a way to earn and store value outside the traditional system - legally.

What’s Next?

PVARA’s roadmap shows this is just the beginning. By 2027, the government expects to have 10-15 major mining facilities operating under license. Each will be required to publish quarterly energy and hash rate reports. There are talks of creating a national crypto mining zone near coal regions in Punjab and Sindh, with dedicated grid connections and tax incentives.

But the real test will be enforcement. Will banks finally accept crypto-linked accounts? Will the FBR audit miners effectively? Will international firms actually set up shop, or will they wait to see if regulations change again?

One thing is clear: Pakistan is no longer asking whether crypto mining should exist. It’s asking how to do it right - and who gets to benefit.

Comments

kieron reid

February 18, 2026 AT 14:39 PMSo let me get this straight - they’re letting big US and Chinese firms mine with waste coal power, but regular folks can’t plug in a few rigs? Classic. The government didn’t legalize crypto. They just made it a corporate tax dodge with extra steps.