By 2025, the world is no longer asking if digital money will replace cash-it’s asking who will control it. On one side, governments are rolling out Central Bank Digital Currencies (CBDCs) with military-grade precision. On the other, private cryptocurrencies like Bitcoin and Ethereum still hold sway over millions of users who distrust centralized systems. But this isn’t just a tech battle-it’s a power struggle over money, privacy, and national security.

CBDCs Are No Longer Experiments-They’re National Infrastructure

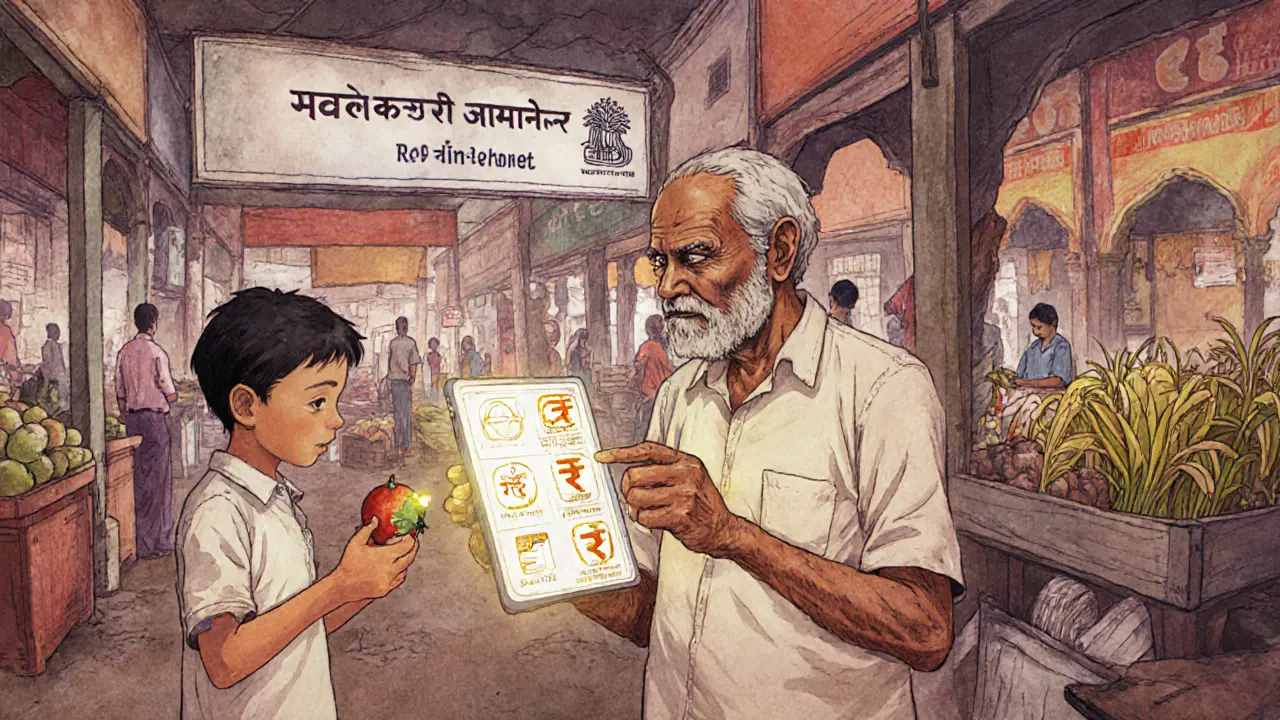

As of 2025, 134 countries, covering 98% of global GDP, are actively working on CBDCs. That’s up from just 114 in 2023. This isn’t a trend. It’s a global shift. Central banks aren’t tinkering with prototypes anymore-they’re building full-scale digital payment systems designed to replace cash and compete with private crypto. Countries like India have gone beyond pilots. The Reserve Bank of India now runs both retail and wholesale CBDCs, supports offline transactions, and lets small businesses and farmers use them without internet. Japan’s Bank of Japan has spent two years testing user interfaces, making sure elderly citizens and rural populations can use the system without needing a smartphone. These aren’t flashy crypto apps. They’re public utilities. And it’s not just about convenience. The real goal? Cut cross-border payment costs. In 2025, $59 billion in international transactions moved via CBDCs-up 45% from the year before. Projects like mBridge (led by China, Thailand, UAE, and Hong Kong) and Project Dunbar (Australia, Singapore, Malaysia, South Africa) are already settling trades between banks in real time, without intermediaries. Private crypto can’t match that scale or speed without sacrificing compliance.Why Private Crypto Is Losing Ground in Key Areas

Bitcoin and Ethereum were born to escape banks. They promised decentralization, censorship resistance, and freedom from government control. But in practice, most people don’t use them to buy coffee or send money abroad. They use them to speculate. And when markets crash, those same users scramble back to traditional banks. CBDCs don’t need to be perfect to win. They just need to be better at the things people actually care about: reliability, speed, and legal protection. If your CBDC transaction fails, you can call your central bank. If your Bitcoin wallet gets hacked? Good luck. Private crypto also struggles with regulation. In the U.S., the SEC still hasn’t decided if Ethereum is a security. In the EU, MiCA is forcing exchanges to comply with strict KYC rules. Meanwhile, CBDCs are built from day one with anti-money laundering (AML) and counter-terrorism financing (CTF) rules baked in. Forty-eight percent of CBDC projects already use blockchain-based identity systems to verify users faster than traditional banks can. And here’s the kicker: 26 central banks are actively building bridges between CBDCs and existing private payment apps like PayPal, Alipay, and Apple Pay. You won’t need a new wallet. You’ll just tap your phone like you always do. Private crypto still forces you to juggle wallets, seed phrases, and exchange accounts. It’s clunky. And users hate clunky.The Regulatory Advantage CBDCs Can’t Ignore

Private crypto thrives in gray zones. CBDCs thrive in clarity. That’s their secret weapon. Central banks have one thing no crypto project can replicate: legal authority. CBDCs are legal tender. They’re backed by the full faith and credit of the state. If you get paid in a CBDC, it’s as good as cash. No volatility. No counterparty risk. No “it’s just a token.” That’s why governments are pushing CBDCs for financial inclusion. In Nigeria, the eNaira helped unbanked farmers receive government subsidies directly. In Jamaica, the JAM-DEX let small businesses accept digital payments without credit card fees. In places where banks don’t reach, CBDCs do. Meanwhile, private crypto remains a luxury for the tech-savvy. You need a smartphone, internet, a crypto exchange account, and the confidence to hold volatile assets. Most people in developing economies don’t have those conditions. CBDCs don’t ask for permission-they just work.

The Real Threat: Bank Runs and Monetary Chaos

But CBDCs aren’t risk-free. The biggest danger isn’t hackers-it’s people. Imagine a sudden economic panic. People lose trust in their banks. They rush to convert their savings into CBDCs. That’s not science fiction. It’s exactly what the IMF warned about in October 2024. If millions of people pull their money out of commercial banks and into CBDCs overnight, banks can’t lend. Credit freezes. The economy stumbles. That’s why countries like Sweden and Canada are limiting how much CBDC an individual can hold. Others, like China, are designing CBDCs to pay zero interest-so people don’t treat them like savings accounts. The goal isn’t to replace bank deposits. It’s to replace cash. Private crypto doesn’t face this problem. Bitcoin doesn’t drain bank reserves. But it also doesn’t help stabilize the economy. It’s a parallel system-useful for some, dangerous for others.Security: CBDCs Are Built for Resilience, Not Anarchy

Crypto fans love to say blockchain is unhackable. It’s not. The Bitcoin network has never been broken-but exchanges have been robbed billions of dollars. Coinbase, Binance, FTX-all fell because of human error, not cryptography. CBDCs, by contrast, are built like Fort Knox. Over 100 central banks are investing in quantum-resistant encryption, hardware security modules, and real-time fraud detection. They’re not relying on decentralized nodes. They’re using centralized, audited systems with multiple layers of backup. The IMF found that while CBDCs create new attack surfaces, they also force governments to upgrade entire payment infrastructures. That means better firewalls, faster incident response, and mandatory cybersecurity standards for all financial service providers. Private crypto doesn’t have that. It’s a Wild West.

The Future: Coexistence, Not Conquest

This isn’t a zero-sum game. CBDCs won’t kill Bitcoin. But they’ll make it irrelevant for most everyday uses. Cross-border payments? CBDCs are winning. Financial inclusion? CBDCs are winning. Regulatory compliance? CBDCs are winning. Private crypto’s future lies in niches: censorship-resistant payments, decentralized finance (DeFi), and as a hedge against hyperinflation in failing states. Venezuela, Argentina, and Lebanon still see Bitcoin as a lifeline. But those are exceptions-not the rule. The real winner? People who get to choose. In New Zealand, you might use KiwiPay (a CBDC-backed app) to pay your rent, then hold a few Bitcoin as a long-term store of value. In Brazil, you might use the digital real to buy groceries, then trade crypto on weekends. That’s the future: layered systems, not one-size-fits-all.What’s Next? Don’t Wait for the Government to Decide

If you’re holding crypto, ask yourself: Are you using it for freedom-or just gambling? If you’re waiting for a CBDC in your country, check your central bank’s website. Most publish roadmaps. India’s digital rupee is live. Nigeria’s eNaira is expanding. China’s digital yuan is in 26 cities. You don’t need to pick a side. But you do need to understand the rules. CBDCs are coming. They’re not evil. They’re not utopian. They’re just the next step in how money works. And if you’re not ready, you’ll be the one stuck with outdated wallets and slow transfers.Are CBDCs the same as Bitcoin?

No. CBDCs are digital versions of your country’s official currency, issued and controlled by the central bank. Bitcoin is a decentralized cryptocurrency with no government backing. CBDCs are legal tender; Bitcoin is not. CBDCs can be traced and regulated; Bitcoin transactions are pseudonymous but not anonymous.

Can I use CBDCs to avoid government surveillance?

Not really. Most CBDCs are designed with transparency in mind. Central banks track transactions to prevent money laundering and tax evasion. Some pilot programs offer limited privacy for small, everyday purchases-but large transfers will always be visible. If anonymity is your goal, private crypto still offers more options, though even those are becoming harder to use without KYC.

Will CBDCs replace cash entirely?

Not anytime soon. Most countries are designing CBDCs to complement cash, not eliminate it. Sweden and Canada are moving fastest toward cashless societies, but even there, cash is still accepted. The goal is to reduce reliance on physical money-not remove it completely. People who rely on cash for privacy or accessibility will still have options.

Why are so many countries rushing to launch CBDCs now?

Three reasons: First, private crypto and stablecoins like USDT are already being used for cross-border payments, bypassing traditional banking. Second, China’s digital yuan is ahead, and other nations don’t want to fall behind in global finance. Third, CBDCs give governments better control over monetary policy, reduce fraud, and improve financial inclusion-especially in rural or unbanked areas.

Can private crypto survive alongside CBDCs?

Yes, but only in specific roles. CBDCs will dominate everyday payments, government transactions, and regulated finance. Private crypto will survive where decentralization matters most: censorship-resistant transfers, DeFi lending, and as a hedge against inflation in unstable economies. Think of it like email vs. postal mail-both exist, but for different needs.

What should I do if my country launches a CBDC?

Don’t panic. Wait for official guidance from your central bank. Download their app only from official sources. Don’t convert all your savings into CBDCs unless you understand the limits. Use it for daily spending if it’s faster or cheaper. Keep your crypto separate if you value its decentralized nature. The key is balance-not replacement.

Comments

Brian Gillespie

November 13, 2025 AT 01:35 AMCBDCs are just cash with a tracking chip. People don’t want surveillance, they want reliability. And right now, that’s what they’re getting.

Michael Faggard

November 14, 2025 AT 05:35 AMLet’s cut through the crypto evangelism. CBDCs aren’t about control-they’re about efficiency. Real-time settlement, programmable money, cross-border rails that don’t need SWIFT. The infrastructure is already built. Bitcoin’s still stuck on block confirmations and gas fees. It’s not a competition-it’s obsolescence.

Elizabeth Stavitzke

November 14, 2025 AT 14:02 PMOh wow, the great and powerful central banks are finally catching up to… what? The fact that people want to move money without middlemen? Please. You call that innovation? We’re just swapping one monopoly for another. At least Bitcoin doesn’t need your Social Security number to send $5.

Ainsley Ross

November 14, 2025 AT 22:24 PMAs someone who has worked in financial inclusion across Southeast Asia, I can tell you: CBDCs are transformative. In rural India, farmers are receiving subsidies directly via the digital rupee-no intermediaries, no delays, no corruption. This isn’t about control. It’s about dignity. Private crypto doesn’t reach these people. It doesn’t even try.

And yes, privacy concerns exist. But most CBDC pilots offer tiered privacy: small daily transactions are anonymous; large transfers are auditable. That’s not surveillance-it’s responsible governance.

Let’s stop framing this as freedom vs. control. It’s access vs. exclusion. And right now, CBDCs are winning that battle.

Arthur Crone

November 16, 2025 AT 15:26 PMCBDCs are the final step in the state’s total monetization of your life. You think you’re choosing convenience? You’re choosing compliance. Every transaction logged. Every purchase monitored. Every ‘suspicious’ flow flagged. Crypto might be messy-but at least it doesn’t report you to the IRS for buying coffee.

And don’t get me started on ‘financial inclusion.’ You don’t include people by forcing them into a system that watches them. You include them by giving them choice. CBDCs eliminate choice. That’s not progress. That’s control dressed in UI/UX.

Laura Hall

November 18, 2025 AT 00:23 AMY’all are acting like this is a war between good and evil. It’s not. CBDCs are a tool. Bitcoin is a tool. The question isn’t which one wins-it’s which one fits your life. I use the digital dollar for bills. I hold BTC for long-term value. I use PayPal for my Etsy shop. Why can’t we just… coexist?

Also, if you’re mad about surveillance, go use Monero. Don’t blame the CBDC for your own paranoia.

Ashley Mona

November 19, 2025 AT 22:33 PMLet’s be real-CBDCs are the only thing keeping fiat from collapsing under its own weight. Inflation? Check. Debt? Check. Trust in banks? Dead. CBDCs give governments a way to steer the economy without printing trillions into oblivion. And yes, they’re traceable. So what? If you’re not doing anything shady, why are you scared of transparency?

Also, Bitcoin’s energy use is wild. CBDCs run on existing infrastructure. That’s not evil. That’s smart.

Debraj Dutta

November 20, 2025 AT 11:01 AMIn India, the digital rupee is quietly changing lives. My aunt in Bihar used to wait 3 weeks for her pension. Now it hits her phone in 2 hours-even without internet. She uses USSD codes. No app. No smartphone. Just a basic phone. That’s real inclusion. Crypto can’t do that. And no, we don’t need to ‘choose’ between them. We need both.

BRYAN CHAGUA

November 21, 2025 AT 05:19 AMIt’s fascinating how we frame this as a battle when it’s really a transition. Cash didn’t disappear overnight. Neither will CBDCs. The real story isn’t who wins-it’s how we adapt. The next decade won’t be about crypto vs. central banks. It’ll be about hybrid systems: programmable money, smart contracts on CBDC rails, tokenized assets backed by sovereign currency. The future isn’t either/or. It’s and.

Rachel Everson

November 22, 2025 AT 02:41 AMMy cousin in Nigeria got her first digital payment via eNaira last month. She runs a small tailoring shop. No bank account. No card. Just a phone. She paid her supplier, saved for her kid’s school, and even sent money to her sister in Ghana-all in under 10 minutes. No fees. No middlemen. No drama. That’s not ‘control.’ That’s liberation.

Stop romanticizing crypto. For most of the world, it’s a luxury. CBDCs are a lifeline.

Adrian Bailey

November 23, 2025 AT 02:46 AMOkay but like… imagine this: you’re 72, you don’t use smartphones, you’re scared of ‘crypto stuff,’ but your pension is now paid via CBDC and you can just walk into the corner store and pay for milk with your phone tap. No cash, no card, no PIN. Just tap. And it works. Even when the internet’s slow. Even when the power flickers. And you don’t need to know what blockchain is. You just know it works. That’s the real win. Not the tech. Not the ideology. Just… functionality.

And yeah, I get the surveillance fears. But if you’re not stealing from the state, why does it matter if they know you bought eggs? It’s not like they’re gonna show up at your door because you spent $4 on bread.

Also, I accidentally sent 0.001 BTC to a random wallet last week. Lost it forever. CBDCs? I can reverse it. No drama. Just call the bank. That’s peace of mind.

Joanne Lee

November 24, 2025 AT 15:52 PMIt’s worth noting that the IMF’s warning about bank runs via CBDCs is not theoretical. Sweden’s Riksbank has already modeled scenarios where 15% of household deposits shift to CBDCs within 72 hours during a crisis. That’s not a bug-it’s a feature. Central banks are designing limits, tiered interest rates, and withdrawal caps precisely to avoid systemic collapse. This isn’t authoritarianism. It’s macroeconomic engineering.

Private crypto doesn’t offer this. It offers volatility. And volatility doesn’t stabilize economies. It destabilizes them.

Rebecca Saffle

November 24, 2025 AT 22:21 PMSo let me get this straight-governments are building digital money that can track every purchase I make, freeze my account if I ‘violate policy,’ and charge me fees to use my own money… and you call this progress? I’m sorry, but if I have to choose between a system that monitors me and one that doesn’t, I’m choosing the one that doesn’t. Even if it’s slower. Even if it’s messier. At least it’s mine.

Bitcoin isn’t perfect. But it’s the last thing standing between me and total financial subjugation.

tom west

November 25, 2025 AT 04:30 AMCBDCs are the natural evolution of monetary policy. You think the Fed cares about your privacy? They care about control. They care about interest rate transmission. They care about reducing cash-based crime. Bitcoin’s a relic. It’s not even used for transactions anymore-it’s a speculative asset. CBDCs are the future of money because they’re designed for utility, not ideology.

And don’t even get me started on the energy waste of proof-of-work. CBDCs run on existing infrastructure. Zero carbon overhead. That’s not just smart-it’s responsible.

dhirendra pratap singh

November 25, 2025 AT 11:43 AMCBDCs are the new world order. The elites are coming for your money. They want to control what you buy, who you pay, and when you spend. This isn’t innovation-it’s tyranny. And Bitcoin? It’s the last free thing left. If you’re not holding BTC, you’re already a slave. Wake up.

Also, I lost my whole portfolio in 2022. But I’m still holding. Because freedom > money. 💪🔥

Johanna Lesmayoux lamare

November 26, 2025 AT 15:54 PMMy mom uses CBDC to pay for groceries. She doesn’t know what blockchain is. She just knows it works. And that’s all that matters.

Edward Phuakwatana

November 27, 2025 AT 00:56 AMLet’s zoom out. This isn’t about money. It’s about identity. CBDCs tie your financial existence to your state-issued identity. That’s powerful. That’s dangerous. That’s inevitable. But here’s the twist: the same tech that enables surveillance also enables programmable money-like conditional payments for rent, education, or healthcare. Imagine your child’s school stipend auto-releasing only when attendance is logged. Or your rent payment auto-deducting only after your landlord submits a maintenance receipt.

That’s not control. That’s precision. And it’s coming. Bitcoin can’t do this. It’s a ledger, not a system. CBDCs are the operating system of the new economy. And the people who build the OS? They write the rules.

So ask yourself: Do you want to be part of the system that builds the future-or just a user in someone else’s?

Suhail Kashmiri

November 27, 2025 AT 13:52 PMBro, in India we’ve been using UPI for years. No CBDC needed. People just scan a QR and pay. Fast. Free. No tracking. So why are we even talking about this? CBDCs are just UPI with a government logo.

ty ty

November 28, 2025 AT 05:41 AMSo you’re telling me the government is going to give me digital money… and then watch every time I buy a beer? Cool. I’ll just keep my cash under the mattress. At least then they can’t freeze my account for ‘suspicious activity’ because I bought too many energy drinks.

Wayne Dave Arceo

November 28, 2025 AT 22:09 PMCorrection: 134 countries are developing CBDCs, but only 11 have launched fully operational retail versions. The rest are pilots. Also, mBridge is not ‘settling trades in real time’-it’s conducting cross-border settlement trials with limited participants. And Bitcoin’s ‘speculative use’ is a feature, not a bug-it’s a hedge against monetary debasement. CBDCs are the opposite: they’re designed to enforce monetary policy, not preserve value. The real threat isn’t crypto-it’s the erosion of monetary sovereignty through centralized digital currency. You’re not choosing convenience. You’re choosing servitude.