Iraq Crypto Regulation Comparison Tool

How Iraq Compares Globally

Iraq's 2017 crypto ban remains one of the strictest worldwide. Compare Iraq's policy with other countries to see how regulation approaches differ.

10

10 countries have total crypto bans worldwide

Filter Countries

Key Iraq Facts

- Ban Year: 2017

- Scope: Mining + Trading

- Energy Concerns: Yes

- Religious Considerations: Yes

- Current Status: No Updates Since 2017

Comparison Results

| Country | Region | Regulation Status | Key Features | Energy Policy |

|---|

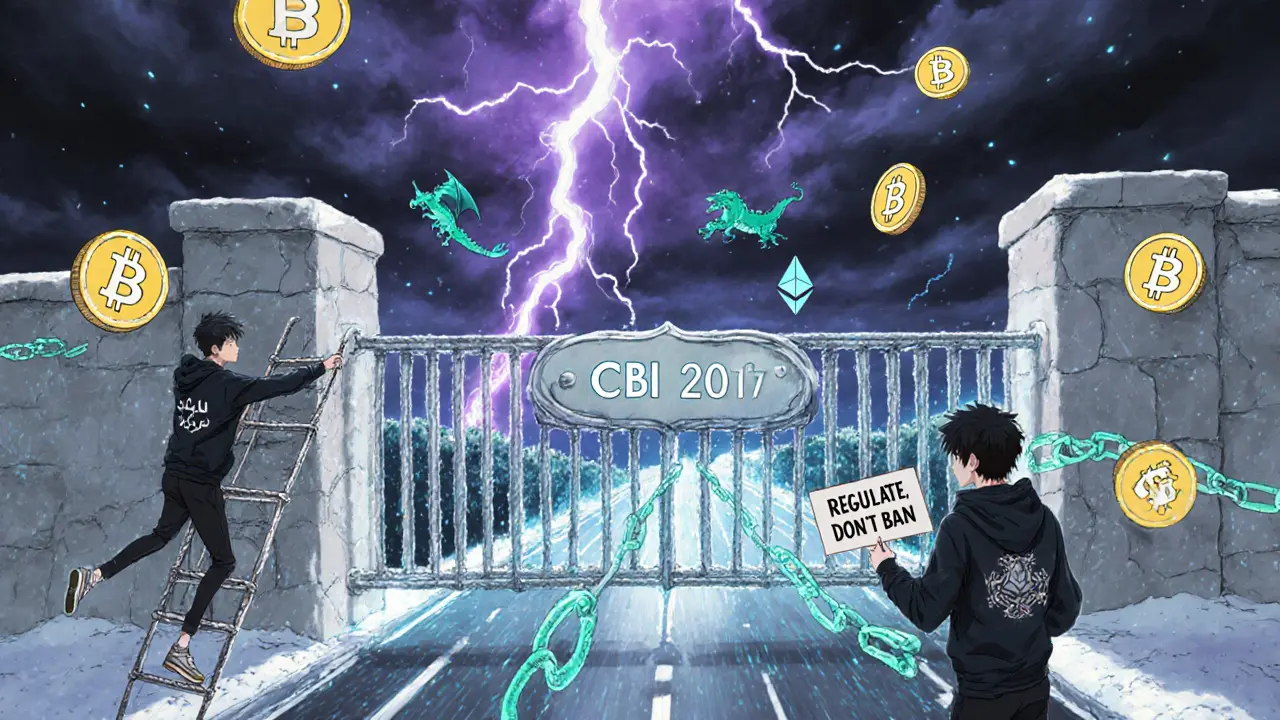

Back in 2017, Iraq made a bold move - it banned cryptocurrency mining and trading outright. No licenses. No exceptions. No gray area. The Central Bank of Iraq (CBI) issued a clear directive: digital currencies like Bitcoin, Ethereum, and everything else were off-limits. It wasn’t just a warning. It was a full stop. And seven years later, that ban is still in place - even as the world moves on.

Why Did Iraq Ban Crypto in 2017?

The Central Bank didn’t wake up one day and decide to outlaw Bitcoin because they disliked it. They had real concerns. Iraq’s financial system was (and still is) fragile. Banks struggled with trust, transparency, and basic infrastructure. Cryptocurrencies, with their anonymous transactions and decentralized networks, looked like a threat - not an opportunity. The CBI pointed to three big problems: money laundering, uncontrolled volatility, and the lack of any legal framework to track or tax digital asset activity. In a country where cash still dominates and formal banking reaches only about 60% of adults, letting in something as wild as crypto felt like inviting a wildfire into a dry forest. They also worried about energy use. Bitcoin mining eats electricity - a lot of it. Iraq already struggles with power shortages. The CBI’s 2017 statement even referenced environmental risks, making Iraq one of the first countries to link crypto mining to energy policy. Greenpeace later noted Iraq was among the earliest to raise this issue publicly. It wasn’t just the central bank. In 2018, the Kurdistan Regional Government’s Supreme Fatwa Committee added its voice, declaring OneCoin - a notorious crypto scam - illegal under Islamic law. That made it clear: this wasn’t just a financial decision. It was a cultural and religious one too.Who Got Caught?

The law says crypto trading or mining is illegal. But does anyone actually get punished? According to underground sources, at least two people were arrested in Baghdad and Basra for running crypto operations. One was caught running a small mining rig in his garage. Another was found transferring Bitcoin through peer-to-peer apps. But here’s the twist: no formal trials have been reported. Lawyer Hayan Al-Khayyat says he’s never seen a case go to court specifically for crypto trading. That’s not because the law isn’t there - it’s because enforcement is patchy. Most people who trade crypto in Iraq do it quietly. They meet in cafes, whisper about wallets, use Facebook groups to swap keys, and avoid using their real names. Ahmed Crypto, a 33-year-old from Baghdad, says he used to run a small office for crypto exchanges. Then came the warnings. Now he works from home, encrypted and hidden. "They call it backward," he says. "But if they can’t regulate it, why ban it?" His $10,000 in Bitcoin isn’t sitting in a bank. It’s in a cold wallet, hidden in a safe. He’s not alone. Hundreds, maybe thousands, of Iraqis are doing the same thing. The ban didn’t kill crypto - it just pushed it underground.How People Still Trade Crypto in Iraq

You won’t find a Bitcoin ATM in Baghdad. You won’t see a crypto exchange listed on Google. But you’ll find people trading on Telegram, WhatsApp, and Facebook Marketplace. The process is simple: find someone in a local group, agree on a price in Iraqi dinars, meet in a public place, hand over cash, and get a private key sent to your phone. No ID. No paperwork. No traceable bank record. It’s peer-to-peer trading at its most raw. Some use remittance services to move money abroad, then buy crypto on international exchanges. Others trade directly with traders in Turkey or Jordan, where crypto is legal. The border is porous. The internet is everywhere. And the demand? It’s growing. Ashur Al-Nuaimi, another trader, says the real problem isn’t crypto - it’s ignorance. "The Central Bank doesn’t understand blockchain," he says. "They see it as magic money. They don’t know it’s a ledger. They don’t know it can’t be forged. They’re scared of what they don’t understand."

The Economic Cost of the Ban

The ban didn’t just affect hobbyists. It hit businesses too. Iraqi exporters struggle to get paid by foreign buyers. Traditional wire transfers take days, cost up to 8% in fees, and often get frozen due to overzealous anti-money laundering checks. Crypto could have solved this - fast, cheap, borderless. But it’s illegal. Importers face the same problem. Paying for goods from China or Turkey? Banks reject transactions flagged as "high risk." Some businesses now pay in cash through intermediaries - a risky, slow, expensive workaround. The result? Higher prices. Slower trade. Lost opportunities. A 2024 World Bank report noted that Iraq’s crypto ban contributes to its low ranking in cross-border payment efficiency - worse than most countries in the Middle East. Meanwhile, neighboring countries like Jordan and Lebanon quietly allow crypto use. Iraqi entrepreneurs cross the border to open crypto-linked businesses. The ban isn’t stopping innovation - it’s just making it harder, riskier, and more expensive.How Iraq Compares to Other Countries

Iraq isn’t alone. As of 2025, only ten countries have total crypto bans: China, Egypt, Algeria, Bangladesh, Nepal, Afghanistan, Morocco, Bolivia, Russia, and Iraq. China shut down mining in 2021 to cut energy use and control capital flight. Egypt banned crypto for religious and economic reasons. Bangladesh criminalized possession - you can be jailed for holding Bitcoin. But here’s the difference: most of these countries are tightening enforcement. China built a digital yuan to replace crypto. Egypt is exploring a regulated crypto sandbox. Bangladesh is studying how to tax it. Iraq? Nothing. No review. No pilot. No committee. The Central Bank hasn’t changed its stance since 2017. Even when Bolivia reversed its 2014 ban in 2024 to allow regulated crypto transactions, Iraq stayed silent. It’s not that Iraq is more strict. It’s that it’s stuck. No one’s pushing for change. No one’s proposing alternatives. The ban is frozen in time.

Comments

Ella Davies

November 16, 2025 AT 06:49 AMInteresting how Iraq’s ban mirrors early internet censorship in authoritarian states. The fear isn’t crypto-it’s losing control over information flow. The underground market is thriving precisely because the system failed people. This isn’t rebellion, it’s survival.

Also, the energy argument is ironic. Iraq burns gas flares daily to generate power. If they regulated mining, they could turn waste energy into economic value. Instead, they’re punishing innovation to protect a broken system.

World Bank data shows this is costing Iraq billions in lost trade efficiency. And yet no one in the CBI seems to care.

Gaurang Kulkarni

November 16, 2025 AT 22:52 PMPeople still trade crypto in Iraq like it’s 2008 black market alcohol during prohibition. The ban didn’t stop demand it just made it dangerous. No legal recourse no consumer protection no recourse if you get scammed. And the central bank thinks this is stability. LOL. They’re not protecting the economy they’re preserving their own irrelevance.

Meanwhile Jordan Lebanon Turkey all quietly let it happen. Iraq’s youth are building wealth outside the system because the system is broken. The real crime isn’t Bitcoin it’s the refusal to adapt.

Also why does every central bank act like blockchain is some alien tech when it’s literally just a shared spreadsheet with encryption. We’ve had this conversation for a decade. Move on.

Henry Lu

November 17, 2025 AT 13:52 PMLOL Iraq bans crypto because they dont understand it. Meanwhile China built a digital currency and Russia is mining like mad. Iraq is still stuck in 2017 pretending the internet is a fad. The CBI is just a bunch of accountants scared of code. Blockchain is the future. If you cant regulate it you’re not a central bank you’re a museum curator.

Also the energy argument is laughable. Iraq’s grid is a joke. If they wanted to save power they’d fix the transformers not ban Bitcoin. This isn’t policy its panic.

nikhil .m445

November 19, 2025 AT 11:30 AMDear friends I must say with all due respect that the situation in Iraq is not just about finance but about moral and spiritual safety. Bitcoin is a form of gambling and gambling is haram. Even if the world moves forward we must not follow the path of corruption. The Central Bank is doing God’s work by protecting the people from the devil’s currency. 🙏

Also I have read this article 3 times and I think the author is very smart. But they missed the point. It’s not about regulation it’s about faith. We must remain pure. 🤲

Rick Mendoza

November 21, 2025 AT 02:11 AMEveryone here is overthinking this. Iraq banned crypto because they’re scared. That’s it. No deep analysis needed. No economic models. No blockchain lectures. Just fear. And fear is the only thing that hasn’t changed in Iraq since 2003.

They’re not protecting the people. They’re protecting themselves. The moment they open the door to crypto they open the door to transparency. And transparency kills corruption.

So they keep the ban. And the people keep trading. Simple.

Lori Holton

November 21, 2025 AT 09:25 AMLet me be clear: this isn’t a ban. It’s a psyop. The Central Bank knows crypto can’t be stopped. They’re using the ban as a smokescreen to justify surveillance. Every P2P transaction is being logged. Every WhatsApp group monitored. Every cafe meeting tracked. The underground isn’t hiding from the law-it’s being herded into a digital cage.

They’re not banning Bitcoin. They’re banning privacy. And the real victims? The women who use crypto to send money home without their husbands knowing. The students who pay for online courses. The refugees who need to survive. This isn’t policy. It’s control.

And yes. I’m paranoid. But after watching what happened in Iran and Venezuela? I’m not wrong.

Bruce Murray

November 22, 2025 AT 04:16 AMIt’s sad but not surprising. When institutions fear change more than collapse they choose the latter. Iraq’s ban is a quiet tragedy. It’s not about crypto. It’s about a generation being told their tools are illegal because the old guard doesn’t know how to use them.

But here’s the hopeful part: the underground is growing. People are learning. They’re building networks. They’re bypassing the system without violence. This isn’t rebellion-it’s evolution.

One day Iraq will catch up. And when it does, the people who kept trading in silence will be the ones who saved the economy.

Barbara Kiss

November 23, 2025 AT 11:35 AMWhat we’re witnessing isn’t a policy failure-it’s a metaphysical one. The Central Bank sees money as a tower. A rigid, vertical structure controlled from the top. But crypto is a network. A web. A decentralized organism that thrives on trust not authority.

The ban is an attempt to impose a medieval model onto a post-digital reality. It’s like banning the printing press because it made books too easy to copy. The fear isn’t of technology. It’s of losing the illusion of control.

And yet-every time someone in Baghdad sends $100 via Telegram to their cousin in Amman, they’re not breaking a law. They’re practicing democracy. One transaction at a time.

Aryan Juned

November 23, 2025 AT 13:26 PMBrooooooo this is the most fire article I’ve read all year 🤯🔥

Iraq is literally the only country that banned crypto and still has 2000 people mining in basements with stolen electricity 😭

They think they’re stopping it but they’re just making it cooler. Now it’s like a secret society. Crypto = rebel status. I wish I was Iraqi just to be part of this underground movement 😭💎

Also the fact that the CBI hasn’t changed a word since 2017? That’s not policy. That’s a coma. Wake up Iraq 🇮🇶⚡

Nataly Soares da Mota

November 24, 2025 AT 01:10 AMThe real tragedy here is epistemic. The CBI operates on a paradigm of centralized monetary sovereignty-a 20th-century construct that assumes control is synonymous with stability. But in a networked world, control is an illusion. What we have here is a cognitive dissonance between institutional inertia and emergent technological reality.

Blockchain isn’t just a ledger-it’s a protocol for trust redistribution. The ban doesn’t eliminate risk; it externalizes it. The underground economy isn’t an anomaly-it’s a feedback loop of institutional failure.

And yet the absence of regulatory innovation isn’t neutrality. It’s complicity. The state isn’t protecting its citizens. It’s abdicating its fiduciary duty to the very people it claims to serve.

When the architecture of value shifts, the architects must adapt-or become artifacts.