May 2025 Market Archive – Crypto, Stocks & DeFi Insights

When reviewing May 2025 Market Archive, a curated collection of crypto, blockchain, and equity analysis from May 2025. Also known as May ’25 Market Review, it helps traders spot trends across digital assets and stocks. This period was packed with Bitcoin breaking past the $70k mark, several altcoins rallying on new layer‑2 upgrades, and the S&P 500 reacting to earnings surprises. At the same time, DeFi protocols showed record‑high TVL, forcing analysts to rethink risk models. By the end of the month, the market narrative shifted from pure speculation to a mix of fundamentals and on‑chain signals.

One of the core pieces in the archive is cryptocurrency, digital money like Bitcoin, Ethereum, and emerging altcoins. Cryptocurrency price action drives a lot of the discussion because it reacts quickly to news and on‑chain data. For example, a major exchange added a new futures contract, and within hours the spot market saw a 5% swing. Alongside that, the stock market, the arena of publicly traded companies tracked by indices such as the Dow and Nasdaq posted a surprising rally after tech earnings beat expectations. This dual‑movement shows how traditional finance and digital assets increasingly influence each other.

To make sense of these swings, the archive leans heavily on technical analysis, chart‑based methods like moving averages, RSI, and Fibonacci levels. The May data set includes real‑time chart snapshots, support‑resistance grids, and pattern breakdowns that explain why Bitcoin held above $68k despite a bearish news flow. Technical analysis also helped identify a bullish flag on a mid‑cap tech stock that later outperformed the broader index by 12%. In short, both crypto and equity markets needed solid chart work to separate noise from genuine momentum.

How DeFi and On‑Chain Data Shape the Picture

DeFi trends play a big role in the archive’s narrative. Protocols like Uniswap and Aave posted record transaction volumes, which fed into on‑chain metrics such as active addresses and gas fees. These metrics, in turn, gave analysts a clearer view of user demand and potential price pressure. For instance, a spike in Aave borrow rates in early May hinted at liquidity tightening, and a few days later, several stablecoins saw a modest dip as investors shifted to higher‑yield assets. The link between on‑chain activity and market moves illustrates why DeFi signals are now a staple in any serious market review.

Another important angle covered is macro‑level risk management. The May archive includes risk‑adjusted performance tables, volatility indexes, and stop‑loss strategies that were tested across both crypto and equity portfolios. Readers can see how a 10% trailing stop on Bitcoin would have preserved capital during a sudden correction, while a similar approach on a high‑growth stock helped lock in gains without missing the next upside. By blending macro insights with asset‑specific tactics, the collection offers a playbook that works for different risk appetites.

Overall, the May 2025 Market Archive serves as a single stop for anyone wanting to understand how digital currencies, traditional stocks, and DeFi ecosystems interacted during a volatile month. It brings together price data, chart patterns, on‑chain signals, and risk frameworks into a cohesive story. Whether you’re a day trader looking for quick setups or a long‑term investor hunting for structural shifts, the material below gives you the context you need to make informed decisions. Dive into the entries below and see how each piece fits into the bigger market puzzle.

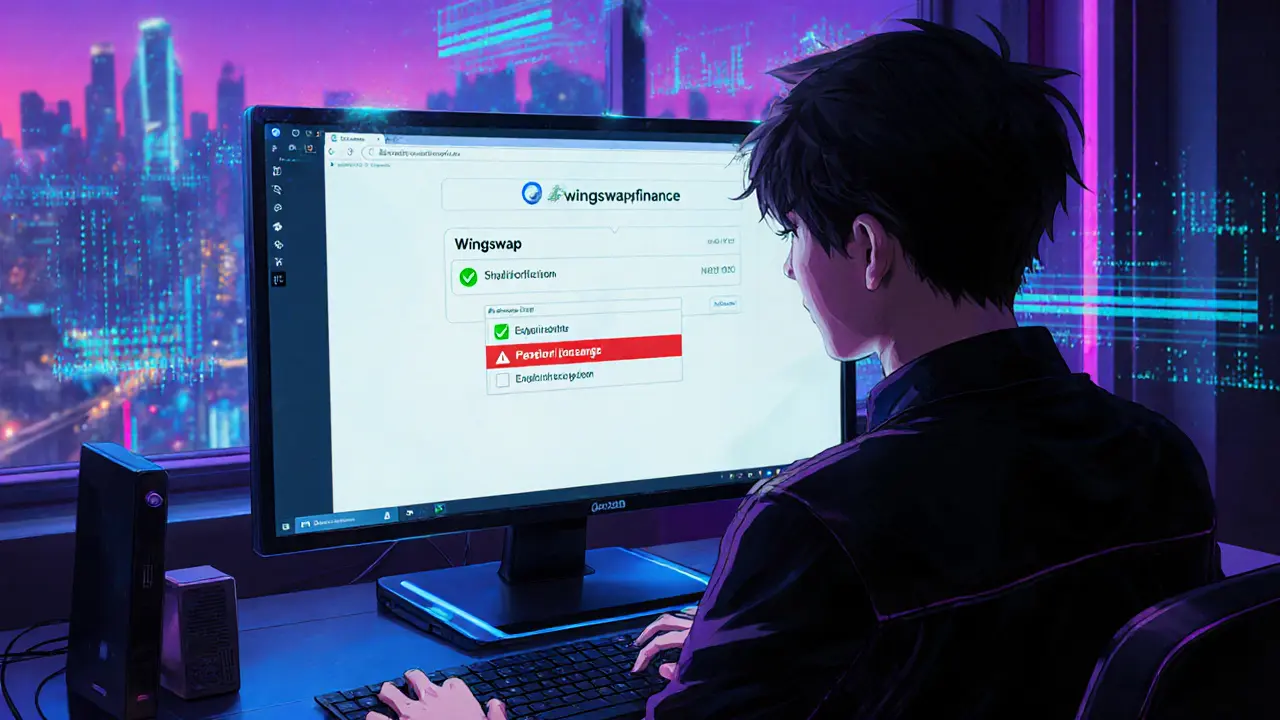

WingSwap Crypto Exchange Review: Legit DEX or Scam?

A detailed WingSwap crypto exchange review that separates the legit Fantom‑based DEX from the HYIP clone, explains token mechanics, safety checks, and how to avoid scams.

The Future of Layer 2 Scaling: What’s Next for Ethereum’s Speed and Cost

Explore how Layer2 scaling solutions are reshaping Ethereum's speed, cost, and future adoption across DeFi, gaming, and enterprise use cases.

SMAK X CoinMarketCap Airdrop Details: Timeline, Tokenomics & Current Price

A detailed look at the SMAK X CoinMarketCap airdrop by Smartlink, covering the campaign timeline, tokenomics, price performance, liquidity issues, and lessons for future airdrop participants.

CRODEX Review: Deep Dive into the DEX Aggregator & CRX Token

An in‑depth CRODEX review covering its DEX aggregator, CRX token economics, security, fees, how to trade, and a side‑by‑side comparison with major exchanges.

GoMining Token Airdrop 2025: Earn GMT & GOMINING Rewards

Learn how to claim GoMining's 2025 airdrop rewards, compare GMT and GOMINING tokens, and avoid common pitfalls in this step‑by‑step guide.