DeFi AMM: The Engine Behind Modern Decentralized Trading

When working with DeFi AMM, an Automated Market Maker that replaces order books with smart‑contract‑driven pricing formulas. Also known as Automated Market Maker, it lets users trade assets instantly by pulling liquidity from pooled funds. This model enables continuous price discovery without a central matcher. Decentralized Exchange (DEX), a platform where users retain custody of their tokens while swapping them relies on a DeFi AMM to calculate swap rates, while Liquidity Pool, a collection of token pairs locked in a smart contract to provide depth for trades supplies the actual capital that makes each swap possible. In short, a DeFi AMM encompasses liquidity pools, requires token swapping algorithms, and influences yield farming returns.

Why Liquidity Pools, Yield Farming, and Impermanent Loss Matter

Liquidity pools are the backbone of any AMM‑based DEX. Providers deposit equal values of two assets, and the pool’s constant‑product formula (x·y=k) ensures that every trade pushes the price along the curve. As more volume hits the pool, providers earn a share of transaction fees, which is where Yield Farming, the practice of staking LP tokens to earn extra rewards enters the picture. Yield farming can boost earnings, but it also raises the risk of Impermanent Loss, the temporary value dip that occurs when the relative price of deposited assets diverges. Understanding how these three entities interact helps traders decide whether the extra reward outweighs the potential loss.

Our collection of posts below walks you through real‑world AMM examples – from reviews of emerging DEXs like Velocimeter, YuzuSwap, and WingSwap, to deep dives on tokenomics, slashing penalties, and token‑burn mechanics that affect AMM economics. Whether you’re curious about how a new AMM token launches, how to spot a safe liquidity pool, or which yield‑farm strategies survive market turbulence, you’ll find practical insights that cut through the jargon. Ready to see the tools, risks, and opportunities that shape DeFi AMMs today? Dive into the articles and start applying what you learn.

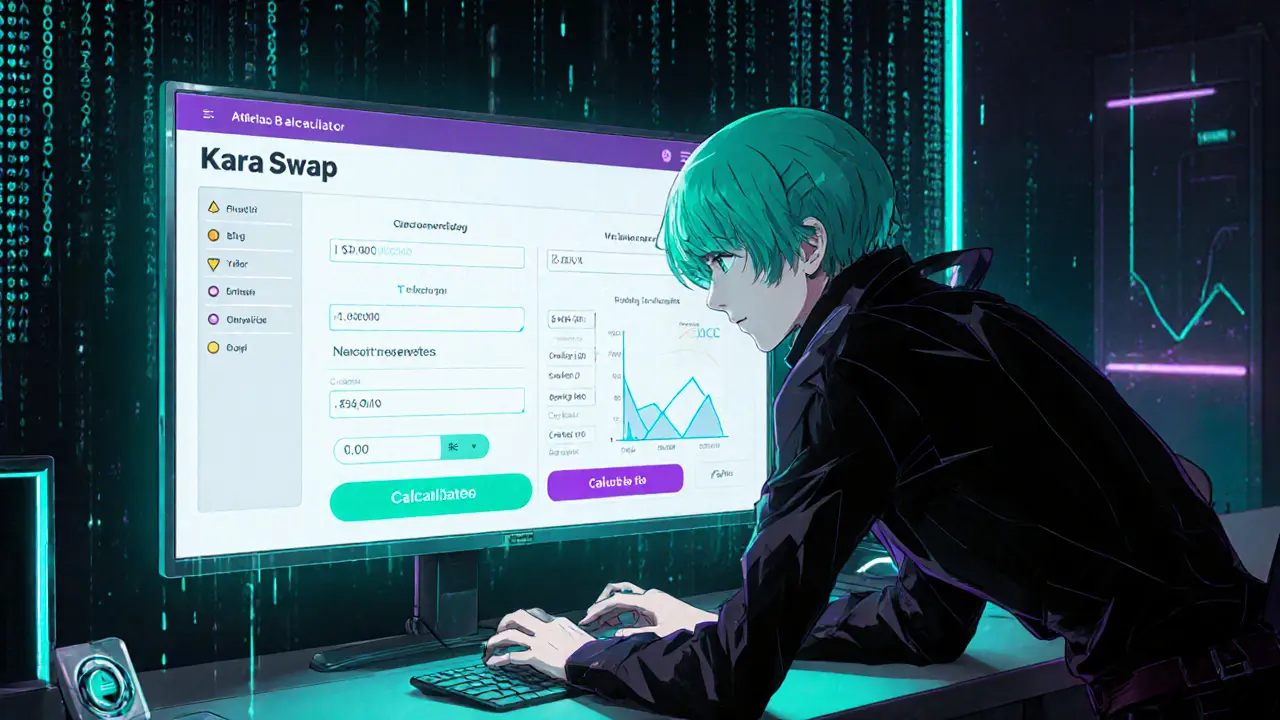

Karura Swap Review: Kusama’s Leading DeFi AMM Exchange

A detailed Karura Swap review covering features, fees, tokenomics, traffic stats, security, and how it compares to other DEXs, helping crypto enthusiasts decide if it fits their DeFi strategy.