Crypto Exchange Scam: Spotting Fraud and Staying Safe

When dealing with crypto exchange scam, a fraudulent activity where fake or compromised platforms trick users into losing crypto assets. Also known as exchange fraud, it can appear as a shiny new exchange, a copy of a trusted site, or a deceptive promotional campaign. Understanding a crypto exchange scam helps you keep hard‑earned coins out of scammers’ wallets. The problem links directly to crypto exchange, any online service that lets users buy, sell, or trade digital assets. Those platforms promise low fees, fast withdrawals, and big bonuses, but when the underlying business is bogus, users end up with empty accounts. To protect yourself, you need reliable scam detection tools, services that scan URLs, analyze contract code, and flag known fraudulent addresses. These tools work hand‑in‑hand with solid exchange security, measures like two‑factor authentication, hardware‑wallet integrations, and regular audits to build a safety net around your trades.

Common Red Flags of Exchange Fraud

First, look for unrealistic promises: guaranteed returns, massive airdrops, or “no‑fee forever” claims. Legitimate exchanges need to cover operational costs, so anything that sounds too good to be true usually is. Second, check the domain and SSL certificates – many fraud sites mimic real URLs but miss subtle spelling errors or use non‑standard TLDs. Third, examine the team’s public profile. Real projects list verifiable LinkedIn or GitHub accounts, whereas scammers hide behind pseudonyms. Fourth, assess liquidity and trading volume. Fake platforms often report inflated figures that don’t match blockchain explorer data. Finally, watch for poor customer support; delayed or generic replies are a warning sign. By cross‑checking these indicators with a reputable scam detection tool and confirming that the exchange follows industry‑standard security practices, you can filter out most fraudulent offers before any funds move.

Beyond the red flags, the broader ecosystem offers alternatives that reduce exposure to scams. Decentralized exchanges (DEXs, platforms that enable peer‑to‑peer trading without a central custodian) let you retain control of private keys, meaning the exchange itself can’t disappear with your assets. However, DEXs come with their own risks, such as smart‑contract bugs, so you still need to run code audits or rely on audited contracts. Combining DEX usage with a solid wallet setup, regular monitoring via on‑chain analytics, and occasional checks with exchange security tools creates a layered defense. In the sections that follow you’ll find detailed reviews of specific platforms, breakdowns of how slashing penalties work, and step‑by‑step guides for spotting and avoiding crypto exchange scams. Dive in to arm yourself with the knowledge that keeps your portfolio safe.

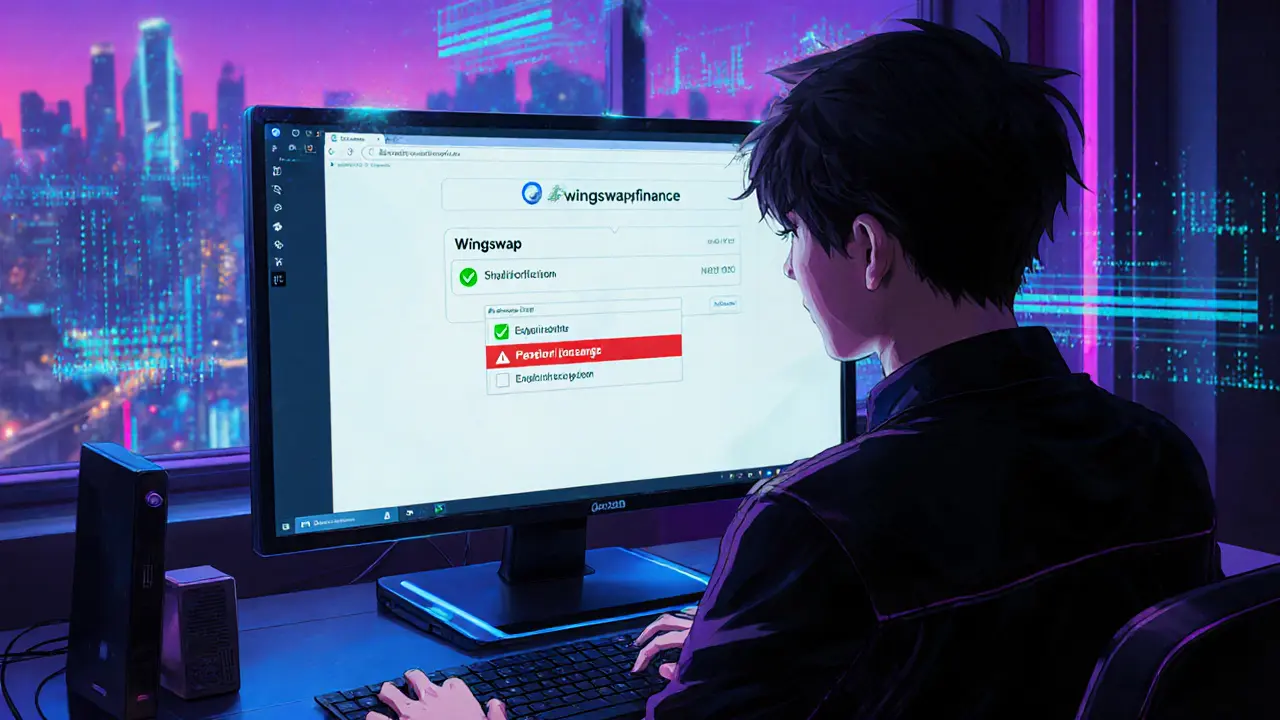

WingSwap Crypto Exchange Review: Legit DEX or Scam?

A detailed WingSwap crypto exchange review that separates the legit Fantom‑based DEX from the HYIP clone, explains token mechanics, safety checks, and how to avoid scams.