Crypto Exchange Safety Checker

The ECB's May 2025 review found 87% of top exchanges hold less than 10% of customer assets in cold storage and only 14 of 37 exchanges have full MiFID II authorization. Check if your exchange meets security standards.

Safety Assessment

Regulatory Status:

Full MiFID II Authorization

Key Security Features:

- Cold Storage: 95% of assets in cold storage

- Proof-of-Reserves: Available

- Multi-Signature Wallets: Enabled

When people search for "EZB crypto exchange," they’re often confused. EZB isn’t a crypto platform like Binance or Kraken. It’s the European Central Bank-Europäische Zentralbank in German, abbreviated as EZB. And if you’re trading crypto in Europe, what the EZB says matters more than any exchange’s marketing page.

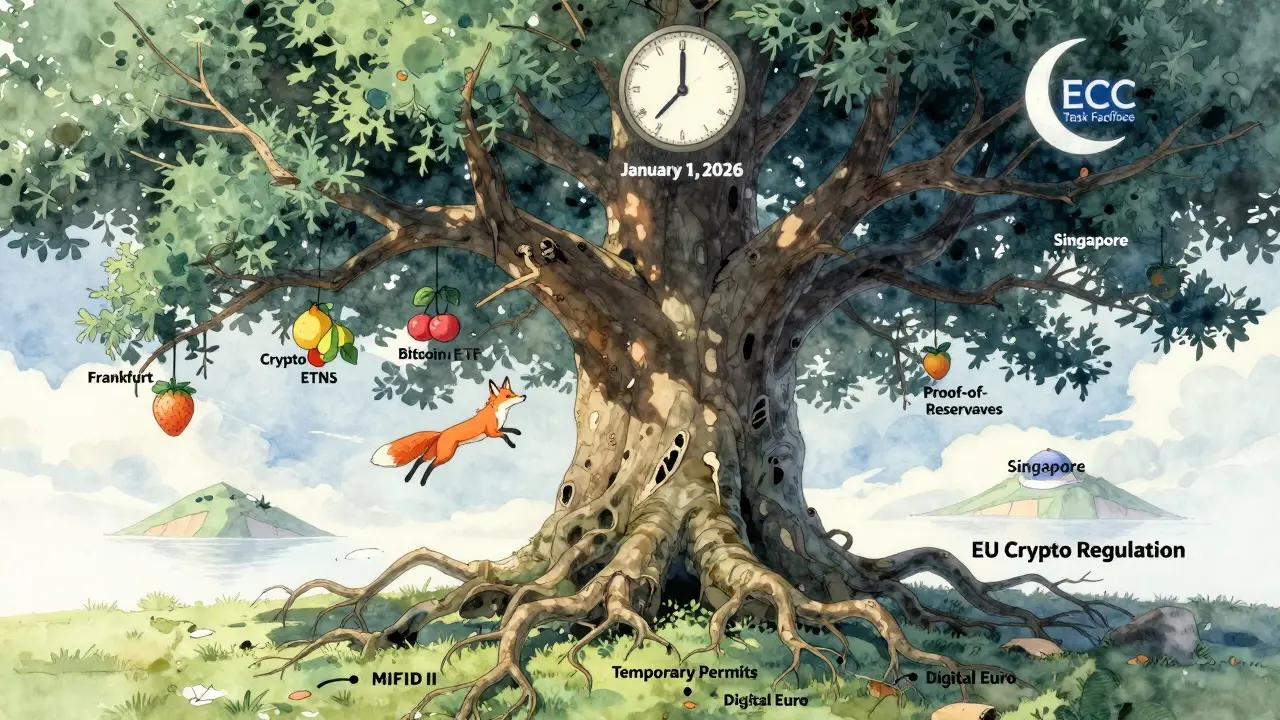

Why the EZB’s Crypto Review Changes Everything

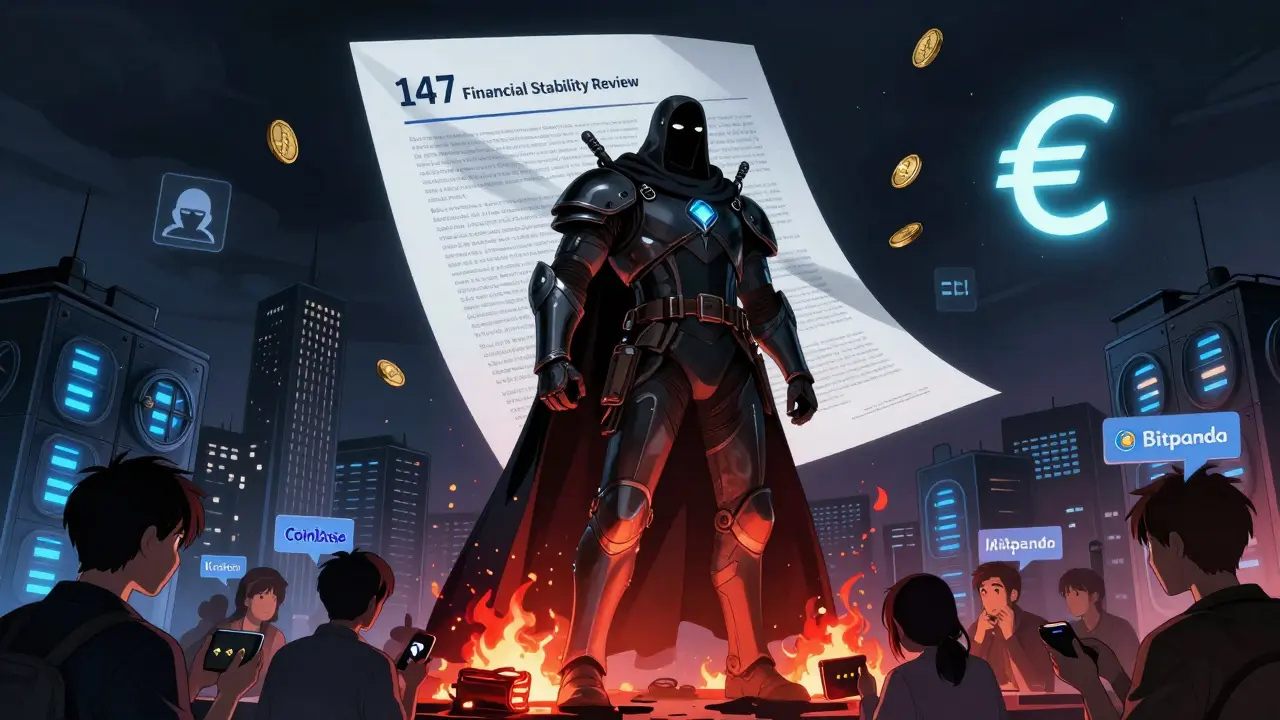

In May 2025, the European Central Bank dropped its most detailed analysis yet on crypto exchanges. It wasn’t a press release. It wasn’t a tweet. It was a 147-page Financial Stability Review titled "Just another crypto boom? Mind the blind spots." This isn’t just bureaucracy-it’s a warning label for every European crypto user. The ECB looked at the 37 largest centralized crypto exchanges in Europe. These are the platforms most people use: Coinbase, Kraken, Bitpanda, and others. What they found wasn’t reassuring. Eighty-seven percent of these exchanges hold less than 10% of customer assets in cold storage. That means if a hacker hits their hot wallets-or if the exchange just vanishes-most users lose their money. And it’s not theoretical. Five of the top ten exchanges had security breaches in 2024. Combined, those breaches cost users $1.27 billion. That’s more than the entire GDP of some small European countries.The Real Problem: No One Knows Who’s Regulated

Here’s the messy part: only 14 of those 37 exchanges have full MiFID II authorization. That’s the EU’s gold-standard financial regulation. The other 22? They’re operating on temporary permits from individual countries-Germany, France, Spain. Each with slightly different rules. This creates chaos. You sign up for an exchange in Germany thinking it’s safe. But if it’s only licensed under a temporary national permit, not full EU-wide MiFID II, your protections are weaker. And if that exchange fails, you’re not covered by investor compensation schemes. Trustpilot data shows the difference. Exchanges with full MiFID II approval average a 4.1/5 rating. Those with temporary permits? 3.4/5. The biggest complaints? "I didn’t know my funds weren’t protected," and "The rules changed overnight."How Crypto Exchanges Are Failing Security Basics

The ECB didn’t just look at numbers. They dug into how exchanges actually handle security. Here’s what they found:- 41% of exchanges don’t prove they hold enough crypto to cover user deposits (no proof-of-reserves).

- 29% don’t use multi-signature wallets-meaning one employee could theoretically drain funds.

- 78% keep more than 40% of assets in hot wallets (online, connected to the internet).

- Only 32% have tested business continuity plans for major outages.

How the ECB Compares to the US and UK

The U.S. SEC repealed SAB 121 in January 2025. That means banks no longer have to list customer crypto as a liability on their balance sheets. It’s a green light for Wall Street to get deeper into crypto. The UK lifted its ban on retail crypto ETNs in October 2025. That means average investors can now buy products tied to Bitcoin through regular brokerage accounts. The ECB? Still saying no. President Christine Lagarde made it clear: "Bitcoin would not be included in the reserve portfolios of central banks under the ECB’s umbrella." They’re not just cautious-they’re skeptical. Germany’s BaFin went even further, banning "pure" crypto ETFs. France, meanwhile, just passed a law allowing digital assets to be pledged as collateral. So you have three major EU countries with three different rules. The result? Innovation is fleeing. CryptoTraderDE on Reddit said they moved their exchange from Frankfurt to Singapore. Why? €220,000 in annual compliance savings. That’s the cost of playing by the ECB’s rules.What This Means for You as a Trader

If you’re in Europe and trading crypto, here’s what you need to do:- Only use exchanges with full MiFID II authorization. Check their website for the license number and regulator name.

- Never leave more than you can afford to lose on an exchange. Withdraw to your own wallet.

- Look for proof-of-reserves reports. Some exchanges publish these monthly. If they don’t, walk away.

- Avoid platforms that don’t use multi-signature wallets for withdrawals.

- Don’t trust "EU-regulated" as a marketing term. Ask: "Which regulation? MiFID II or a temporary national permit?"

The Hidden Cost of ECB Uncertainty

Getting approved by the ECB isn’t cheap. It takes 14 to 18 months. It costs €2.3 million per exchange. You need 127 documents. Forty-three of them are about anti-money laundering for crypto-to-fiat trades. Smaller exchanges? They can’t afford it. Only 28% of platforms with under $100 million in revenue meet the ECB’s 5-minute security response requirement. That means you’re more likely to use a platform that’s under-resourced, under-staffed, and under-regulated. And the ECB’s own budget tells the story. In 2025, they spent €320 million on the digital euro project. They spent €18 million on crypto exchange oversight. That’s a 17:1 ratio. They’re betting on their own currency, not Bitcoin or Ethereum.What’s Next? The Crypto-Asset Supervision Task Force

On September 4, 2025, the ECB announced a new Crypto-Asset Supervision Task Force. 45 staff members. Starting January 1, 2026. This is a big deal. It means they’re finally moving from research to enforcement. But it’s still slow. The digital euro? Still a "long-term aspiration." Meanwhile, crypto markets keep growing. The $2.8 trillion market cap in May 2025? That’s up 183% from 2024. Professional traders in Europe are already feeling the gap. Eurex’s August 2025 survey found 84% believe the ECB’s refusal to approve single-asset crypto ETFs puts European investors at a disadvantage. In the U.S., Bitcoin ETFs moved over $125 billion in assets. In Europe? Almost nothing.Final Reality Check

EZB isn’t a crypto exchange. It’s the regulator watching over them. And right now, it’s playing defense. It’s trying to stop the next FTX, the next Terra collapse, the next $1 billion hack. But in trying to protect you, it’s also holding back innovation. The best exchanges are leaving. The smartest traders are moving capital outside the EU. And the average user? They’re stuck in the middle-wanting exposure to crypto, but unsure which platform is actually safe. The truth? There’s no perfect exchange under the ECB’s current rules. But there are safer ones. And knowing the difference between a MiFID II license and a temporary permit could save you from losing everything.Don’t trust the name on the app. Don’t trust the "EU-regulated" badge. Ask for the license number. Check the regulator’s website. If they can’t show you proof, walk away.

Is EZB a crypto exchange I can trade on?

No, EZB is not a crypto exchange. EZB stands for Europäische Zentralbank, the German abbreviation for the European Central Bank. It’s a central bank, not a trading platform. It regulates crypto exchanges in the Eurozone but doesn’t offer trading services to the public.

What does the ECB’s May 2025 review say about crypto exchange safety?

The ECB’s May 2025 review found that 87% of top crypto exchanges hold less than 10% of customer assets in cold storage, 41% lack proof-of-reserves, and 29% don’t use multi-signature wallets. Five of the top 10 exchanges had security breaches in 2024, leading to $1.27 billion in losses. Settlement times spike during volatility, and spoofing is common in 63% of order books.

Which crypto exchanges are fully regulated by the ECB?

Only 14 of the 37 largest crypto exchanges in Europe have full MiFID II authorization from the ECB. Coinbase and Kraken are two that do. Bitpanda operates under a temporary national permit in Austria, not full MiFID II. Always verify the license number on the exchange’s website and cross-check it with your national financial regulator.

Why are some crypto exchanges leaving Europe?

Because compliance costs are extremely high-€2.3 million per exchange on average-and the regulatory environment is fragmented. Many exchanges, like the one mentioned by Reddit user CryptoTraderDE, moved from Frankfurt to Singapore to save €220,000 annually in compliance costs. The ECB’s slow pace and lack of clear timelines make it hard for startups to operate profitably in the EU.

Should I use a crypto exchange in Europe right now?

You can, but be cautious. Only use exchanges with full MiFID II authorization. Never keep large amounts on an exchange. Withdraw to your own cold wallet. Check for published proof-of-reserves reports. Avoid platforms that don’t use multi-signature wallets. If the exchange can’t clearly explain its regulatory status, don’t trust it.

Is the ECB blocking crypto innovation in Europe?

Yes, by most accounts. While the U.S. and UK are opening doors to crypto ETFs and ETNs, the ECB is holding back. Only 12% of European asset managers offer crypto products, compared to 37% in the U.S. The ECB’s focus on digital euro over crypto assets, combined with slow regulation, has led to a 37% year-over-year increase in European crypto startups relocating outside the EU.

Comments

Eunice Chook

December 14, 2025 AT 19:37 PM87% of exchanges holding less than 10% in cold storage? That’s not negligence-it’s a death wish. If you’re not hodling your own keys, you’re just renting crypto from a landlord who might evict you with a server crash.

Abhishek Bansal

December 15, 2025 AT 11:46 AMWhy are we even talking about this? The ECB doesn’t care about you. They care about the digital euro. Crypto’s just noise to them. Stop pretending they’re here to protect you-they’re here to control you.

Lois Glavin

December 17, 2025 AT 00:57 AMI just started trading last year and this post saved me from putting my life savings on Bitpanda. I didn’t even know the difference between MiFID II and a temporary permit. Thanks for breaking it down so simply. Seriously, if you’re new-read this twice.

Tiffany M

December 17, 2025 AT 12:37 PMOkay but can we just talk about how wild it is that the ECB spent €320M on their own digital currency and only €18M on actual crypto oversight? That’s like spending $10,000 on a new Ferrari and $500 on seatbelts. They’re not protecting us-they’re building their own empire and hoping we don’t notice.

I’ve been in crypto since 2017 and I’ve seen every regulator play this game. The U.S. says ‘we’re open!’ then sues everyone. The UK says ‘come here!’ then taxes you into oblivion. The ECB? They’re just slow, bureaucratic, and terrified of anything that doesn’t have their name on it.

And don’t get me started on the ‘EU-regulated’ marketing crap. I saw a crypto app last week with a tiny EU flag and ‘regulated’ in 8pt font. The fine print said ‘licensed in Malta under temporary permit.’ That’s not regulation. That’s a Halloween costume.

My cousin in Germany lost $18k because his exchange ‘went dark’ after a breach. He thought he was safe because it had a .eu domain. Spoiler: domains don’t protect your money. Licenses do. And most of them? Half-baked.

Stop trusting logos. Stop trusting ads. Stop trusting ‘trusted partners.’ Go to the regulator’s official website. Type in the license number. If it doesn’t pop up? Walk away. No exceptions.

I used to think the ECB was just cautious. Now I think they’re actively sabotaging innovation because they’re scared they’ll lose power. And honestly? I get it. But that doesn’t mean we should let them hold us hostage.

There’s a reason 37% of European crypto startups moved to Singapore. It’s not just tax. It’s sanity. You can’t build something great when every step requires a 147-page PDF and a notary.

If you’re trading in Europe right now? You’re playing Russian roulette with your portfolio. The gun’s loaded. The trigger’s sticky. And the ECB? They’re just watching.

But hey-at least we know the truth now. So let’s use it. Withdraw. Self-custody. Educate. And stop giving these guys the benefit of the doubt.

Bridget Suhr

December 19, 2025 AT 09:49 AMi just checked my exchange and they said they’re 'eu-regulated'... so i assumed they were safe. then i looked up the license number and it was from a company that got shut down in 2023. lol. thanks for the wake up call.

JoAnne Geigner

December 21, 2025 AT 05:19 AMI’ve been thinking about this a lot lately, and I just want to say-this isn’t just about crypto. It’s about trust in institutions. We used to believe banks were safe. Then we learned they weren’t. Now we’re being told exchanges are safe… but they’re not. And the regulators? They’re either too slow, too underfunded, or too invested in their own agendas.

I’m not saying give up on crypto. I’m saying be smarter. Be more careful. And if you’re going to invest, treat it like you’re investing in a startup that might disappear tomorrow-because honestly? That’s what most of these exchanges are.

I’ve started using Coinbase and Kraken because they’re the only ones who’ve published proof-of-reserves. And I only keep what I can afford to lose on them. The rest? In a hardware wallet. No exceptions.

Also, if you’re reading this and you’re new-don’t panic. This isn’t doom. It’s awareness. And awareness is power. You’re not behind. You’re just learning. And that’s okay.

Let’s stop letting fear drive us. Let’s let knowledge drive us instead. And if we all do that? Maybe one day, the ECB will have to catch up.

Scot Sorenson

December 22, 2025 AT 06:58 AMSo the ECB found 63% of order books are spoofed… and yet they still won’t allow retail crypto ETFs? Brilliant. Let’s make it harder for normal people to invest while letting the insiders play with fake numbers. Classic.

Meanwhile, in the U.S., Bitcoin ETFs moved $125B. In Europe? A few million in dark corners. This isn’t regulation. It’s economic isolationism.

Ike McMahon

December 22, 2025 AT 07:07 AMWithdraw to your wallet. That’s the only rule that matters. Everything else is noise.

Kathleen Sudborough

December 24, 2025 AT 05:53 AMI used to think the ECB was just being careful. But after reading this, I realize they’re not being careful-they’re being lazy. They’ve got the power to fix this. They’ve got the resources. But they’d rather spend millions on their own digital currency than actually protect people.

I’ve got friends in France and Germany who lost money because they trusted ‘EU-regulated’ labels. One guy thought his exchange was safe because it had a German flag on the homepage. Turns out, it was registered in Cyprus with a temporary permit. He didn’t even know what MiFID II was.

This isn’t about crypto being risky. It’s about people being misled. And the ECB? They’re not stopping it. They’re enabling it by being vague.

I’m not mad. I’m just… disappointed. We could have had something great here. A real European crypto ecosystem. But instead, we got bureaucracy, confusion, and a lot of empty promises.

If you’re reading this and you’re thinking about trading? Please, just read the license number. Don’t trust the logo. Don’t trust the colors. Don’t trust the ‘trusted by millions’ banner. Go to the regulator’s site. Type it in. If it’s not there? Don’t touch it.

And if you’re an exchange? Do better. Publish your reserves. Use multi-sig. Be transparent. The users are ready. The regulators just need a push.

Kathryn Flanagan

December 24, 2025 AT 13:00 PMOkay so let me break this down real simple for anyone who’s still confused. The ECB is not a crypto exchange. It’s the boss of all the crypto exchanges in Europe. And right now, most of these exchanges are like kids trying to drive a car without a license. They’re speeding, they’re not checking mirrors, and half of them don’t even have brakes.

Only two out of the big three-Coinbase and Kraken-have the official license that means they actually follow the rules. Bitpanda? They’re like the kid who got a temporary permit from their dad to drive the family car. It’s okay for now, but if something goes wrong? You’re on your own.

And here’s the scary part: 78% of these exchanges keep most of your money online. That means if a hacker gets in, your crypto is gone. Poof. Like it never existed.

And guess what? Most of them don’t even check if they have enough money to cover what you deposited. That’s like a bank saying, ‘we have $100 in the vault, but we’ve promised $1,000 to customers.’

So what should you do? Simple. Only use Coinbase or Kraken. Take your money out of there and put it in a wallet you control. Like a Ledger or Trezor. It’s like locking your cash in a safe at home instead of leaving it on your kitchen counter.

And if you see an exchange saying ‘EU-regulated’? Ask them: ‘Which regulation? MiFID II or a temporary permit?’ If they can’t answer, walk away. No questions. No second chances.

This isn’t fear-mongering. This is just how the system works right now. And if you don’t understand it? You’re gonna lose money. And that’s on you.

But hey-you’re reading this now. So you’re already ahead of 90% of people. Good job. Keep going.

Jessica Petry

December 25, 2025 AT 03:36 AMIt’s not about regulation. It’s about control. The ECB doesn’t want you to have crypto. They want you to have their digital euro. And they’ll use every excuse-safety, stability, ‘consumer protection’-to make that happen. This isn’t oversight. It’s colonization.

amar zeid

December 26, 2025 AT 00:30 AMInteresting analysis, but I wonder if the ECB’s hesitation is actually a form of wisdom. Crypto is volatile, unregulated, and often used for illicit purposes. Maybe slow regulation is better than fast chaos. The U.S. and UK are rushing in-will they regret it in 5 years?

Jeremy Eugene

December 27, 2025 AT 16:34 PMWhile the ECB’s approach may appear overly cautious, it is grounded in institutional responsibility. The systemic risks posed by unregulated crypto entities necessitate rigorous oversight. Premature liberalization could lead to cascading financial instability, particularly in a monetary union with shared liabilities.

Nicholas Ethan

December 28, 2025 AT 12:39 PM87% cold storage deficiency. 41% no proof of reserves. 63% spoofing. 1.27B lost. 28% of small exchanges fail 5-min response. ECB budget ratio 17:1. 37% startup exodus. 14/37 MiFID II. Coinbase and Kraken only. End.

Tiffany M

December 28, 2025 AT 14:58 PMAnd yet, people still say ‘just use a hardware wallet’ like that solves everything. It doesn’t. If the exchange you’re buying from is rigged, you’re still getting scammed. You’re just holding the scam in your own wallet now.

That’s why transparency matters. That’s why proof-of-reserves matters. That’s why multi-sig matters. Because even if you’re self-custodial, you’re still trusting the exchange to not front-run you, not manipulate prices, not steal your funds before you even buy.

So don’t just withdraw. Demand more. Ask for audits. Ask for public keys. Ask for real-time verification. If they won’t give it to you? They’re not worth your time.

Kathleen Sudborough

December 28, 2025 AT 20:42 PMYou’re right. Self-custody doesn’t fix the root problem. The exchange is still the gatekeeper. They control the price feed. They control the liquidity. They control whether your buy order even goes through. And if they’re manipulating the order book? You’re not safe, even with a Ledger.

I’ve started using only exchanges that publish live on-chain reserve proofs. And I check them weekly. It’s a pain. But it’s the only way I know I’m not being played.

And honestly? I think the ECB should require this. Not as a suggestion. As a law. Every exchange operating in the EU should be legally required to show real-time, verifiable proof of reserves. No exceptions.