December 2024 Market Insights Archive

When you land on the December 2024 archive, a curated collection of market commentary, price updates, and strategy guides published throughout the month, you get a snapshot of what moved the needle in crypto and equities last month. Also known as the Dec‑2024 roundup, it pulls together real‑time data, on‑chain signals, and macro analysis so you can see patterns without hunting through separate posts.

What’s Inside the Crypto Corner?

The archive shines a light on cryptocurrency, digital assets that run on decentralized ledgers and fluctuate based on market sentiment, network activity, and regulatory news. You’ll find Bitcoin’s price swing after the Fed’s rate decision, altcoin research that breaks down why Ethereum’s gas fees dropped, and a deep dive into DeFi token performance as yield farms reshuffled capital. Each piece links back to on‑chain metrics, so you can verify the narrative with real transaction data.

Beyond price moves, the collection explains how technical analysis, the study of chart patterns, indicators, and momentum that traders use to predict short‑term price direction guides your entry and exit points. Expect step‑by‑step walkthroughs of moving‑average crossovers, RSI thresholds, and Fibonacci retracements applied to both Bitcoin and high‑growth altcoins. The goal is simple: give you a toolbox that works on any chart, whether you trade on a mobile app or a professional terminal.

Switching to the equity side, the archive covers the stock market, the network of exchanges where publicly listed companies are bought and sold, influenced by earnings, macro data, and investor sentiment. December saw tech earnings beat expectations, a surprise rally in consumer staples after inflation cooled, and a detailed look at sector rotation driven by Federal Reserve hints. Each analysis pairs price action with fundamental metrics—like P/E ratios and dividend yields—so you can gauge whether a move is hype or backed by solid earnings.

Underlying all those stories is the blockchain, the distributed ledger technology that powers cryptocurrencies, smart contracts, and many decentralized applications. The archive highlights protocol upgrades, validator participation rates, and cross‑chain bridges that affect token liquidity. By tying blockchain health to market performance, you get a clearer picture of why a coin might surge after a successful network upgrade or why a token stalls when developer activity slows.

Risk management and macro commentary thread through every article. You’ll see how the U.S. jobs report, CPI numbers, and geopolitical events shaped both crypto volatility and stock price swings. The pieces walk you through position sizing, stop‑loss placement, and portfolio diversification strategies that keep losses in check while you chase upside. Whether you’re a day trader or a long‑term investor, the advice stays practical and data‑driven.

All of this sits in one place, ready for you to explore. Below you’ll find the full list of December 2024 posts—each tagged, dated, and linked—so you can jump straight to the topic that matters most right now. Dive in, grab the charts, and start building the next winning trade or investment plan with confidence.

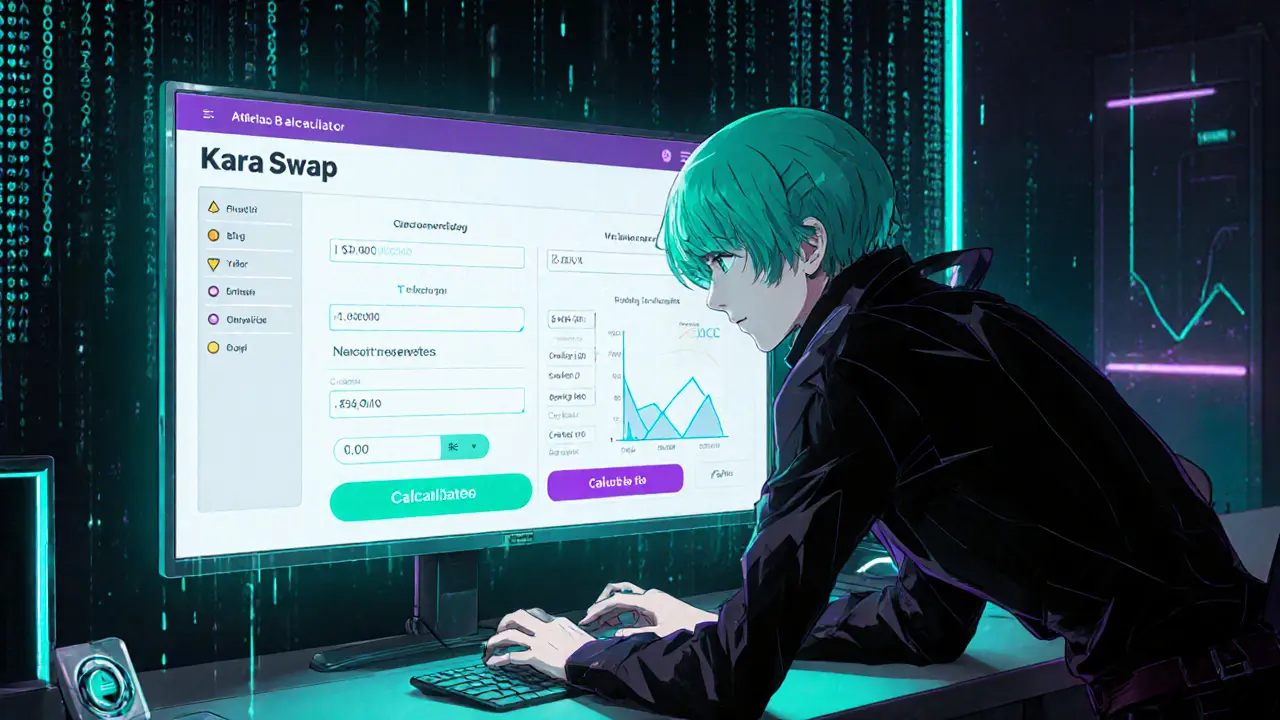

Karura Swap Review: Kusama’s Leading DeFi AMM Exchange

A detailed Karura Swap review covering features, fees, tokenomics, traffic stats, security, and how it compares to other DEXs, helping crypto enthusiasts decide if it fits their DeFi strategy.

MultiSig Security Best Practices: Secure Your Crypto Assets

Learn practical multi‑signature security best practices: choose the right M‑of‑N setup, secure hardware wallets, add MFA, time‑locks, monitoring, and a solid recovery plan for crypto assets.